At least one sizable chunk of the country — 3.7 million people, to be exact — is now more vulnerable thanks to that decision

Photo: Kashin Sergey Alekseevich/Getty Images Last March, Congress tossed a long-overdue lifeline to low-income families: a wide-ranging Child Tax Credit that virtually guaranteed up to $300 per month to nearly all American households with children. The effects of the plan’s expanded benefits were immediately clear: In July, when the first monthly payments went out, child poverty went down by 26 percent and food insufficiency in families with kids dropped by 24 percent.

The expanded Child Tax Credit, which was first passed in March 2021 as part of President Biden’s American Rescue Plan stimulus package, widened the pool of families eligible for support and upped the amount of money they could receive. Before the expansion, child tax credits left out about one-third of all children and nearly half of all Black and Latino families. Single-parent families and those in rural areas were also previously ineligible to get the full credit.

Supporters of the expansion were hopeful the plan would continue past December, when it faced a vote in the evenly divided Senate as part of the Democrats’ $2 trillion Build Back Better Act. That plan ended up dead, thanks in part to West Virginia senator Joe Manchin, who was adamantly opposed to continuing the child tax credit from the start — at one point, he said that he would only support an extension if the benefits were limited to working parents.

. Which makes sense, because Manchin reportedly told his colleagues he was concerned not about the challenges facing low-income parents but the possibility that those parents would spend their child tax credits on drugs. Of course, data from the Census Bureau has found that most families were using the stimulus for basic necessities like food, clothing, shelter, school supplies, tuition, and transportation to and from school.

Now that families have to go without those funds, child poverty is right back up to 17 percent — exactly where it was last January before the expanded tax credits were passed. Unemployment rates are also expected to go up since one in four parents with young kids were using their payments to help cover child care. Meanwhile, Manchin told reporters on Thursday that there were “no formal talks at all” to start renegotiating the Build Back Better plan.

Ireland Latest News, Ireland Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

3.7 million more kids are in poverty without the monthly Child Tax Credit, study saysIn one month, the child poverty rate increased from 12.1 to 17 percent, the highest rate seen since Dec. 2020. Black and Latino children experienced an even higher rate of poverty.

3.7 million more kids are in poverty without the monthly Child Tax Credit, study saysIn one month, the child poverty rate increased from 12.1 to 17 percent, the highest rate seen since Dec. 2020. Black and Latino children experienced an even higher rate of poverty.

Read more »

4 Benefits Of Kids' Sports (That Have Nothing To Do With The Sport Itself)Reality check: Your kid probably won't ever be a top athlete. But they're building some surprising skills they may keep for life.

4 Benefits Of Kids' Sports (That Have Nothing To Do With The Sport Itself)Reality check: Your kid probably won't ever be a top athlete. But they're building some surprising skills they may keep for life.

Read more »

Donald Trump's Kids Ivanka & Donald Jr. Must Testify Alongside Their Dad About the Family BusinessDonald Trump's kids, Ivanka and Donald Jr., will have to respond to judge ordered questions about the Trump Organization.

Donald Trump's Kids Ivanka & Donald Jr. Must Testify Alongside Their Dad About the Family BusinessDonald Trump's kids, Ivanka and Donald Jr., will have to respond to judge ordered questions about the Trump Organization.

Read more »

Father And Stepmother Arrested For Sexually Abusing Their KidsTwo parents in Riverside were arrested after an investigation uncovered their sexual abuse of their daughter and son.

Father And Stepmother Arrested For Sexually Abusing Their KidsTwo parents in Riverside were arrested after an investigation uncovered their sexual abuse of their daughter and son.

Read more »

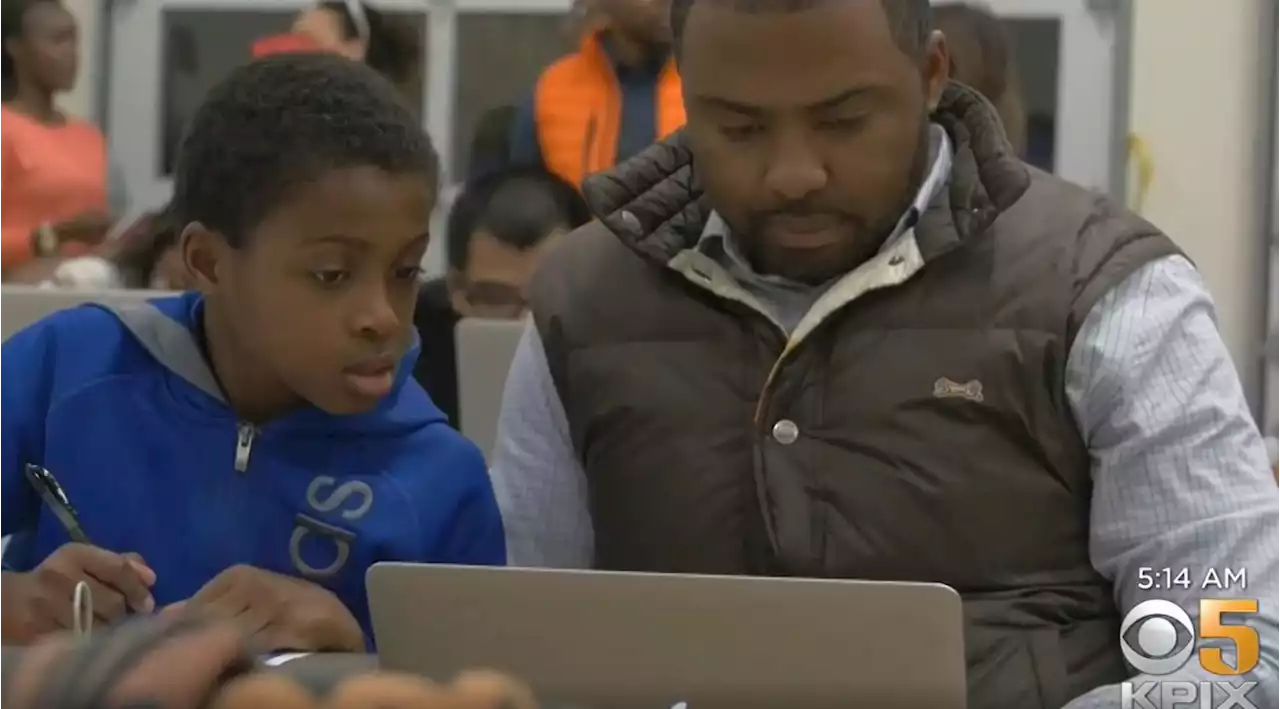

Black History Month: East Palo Alto Nonprofit StreetCode Equipping Kids With Tools For SuccessYou may live just blocks away from a tech company in East Palo Alto, but access to the technology or the tools to be successful could be beyond your grasp. StreetCode Academy is trying to change that.

Black History Month: East Palo Alto Nonprofit StreetCode Equipping Kids With Tools For SuccessYou may live just blocks away from a tech company in East Palo Alto, but access to the technology or the tools to be successful could be beyond your grasp. StreetCode Academy is trying to change that.

Read more »