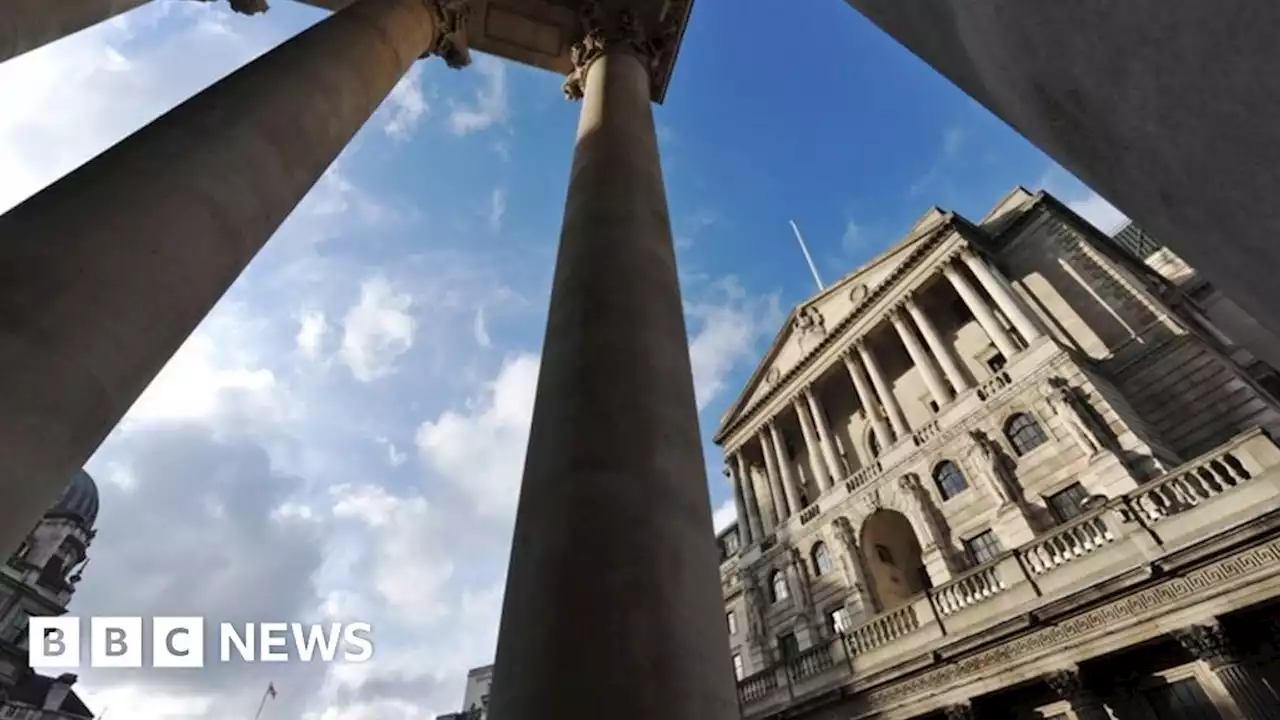

How the Bank of England is supporting the pound

The Bank of England stepped in to calm financial markets after steep falls in the value of the pound and a surge in the UK's borrowing costs.

Its main job is to manage the overall state of the economy, and the stability of the financial system. A central bank can also be a lender to other banks.Streets around the Bank of England's headquarters were destroyed during the Blitz If a government wants to borrow money for its spending plans, they often do it by selling bonds to investors such as big pension funds or banks.

Ireland Latest News, Ireland Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Bank of England Steps in to Restore Stability After IMF WarningBank of England moved to restore stability after the IMF said unfunded tax cuts in the U.K. may fuel inflation and are likely to increase economic inequality

Bank of England Steps in to Restore Stability After IMF WarningBank of England moved to restore stability after the IMF said unfunded tax cuts in the U.K. may fuel inflation and are likely to increase economic inequality

Read more »

Bank of England launches bond-buying programme to prevent 'material risk' to UK financial stabilityWhat is a bond-buying scheme? Sky's pkelso explains the Bank of England's temporary bond-buying programme - launched to prevent what it calls 'material risk' to UK financial stability. Read more:

Bank of England launches bond-buying programme to prevent 'material risk' to UK financial stabilityWhat is a bond-buying scheme? Sky's pkelso explains the Bank of England's temporary bond-buying programme - launched to prevent what it calls 'material risk' to UK financial stability. Read more:

Read more »

Bank of England steps in to calm marketsThe Bank says it will buy government bonds to prevent a 'material risk to UK financial stability'.

Bank of England steps in to calm marketsThe Bank says it will buy government bonds to prevent a 'material risk to UK financial stability'.

Read more »

Bank of England economist hints at 'significant' rate riseThe central bank's chief economist signalled in a speech it could not be 'indifferent' over the pound's slump.

Bank of England economist hints at 'significant' rate riseThe central bank's chief economist signalled in a speech it could not be 'indifferent' over the pound's slump.

Read more »