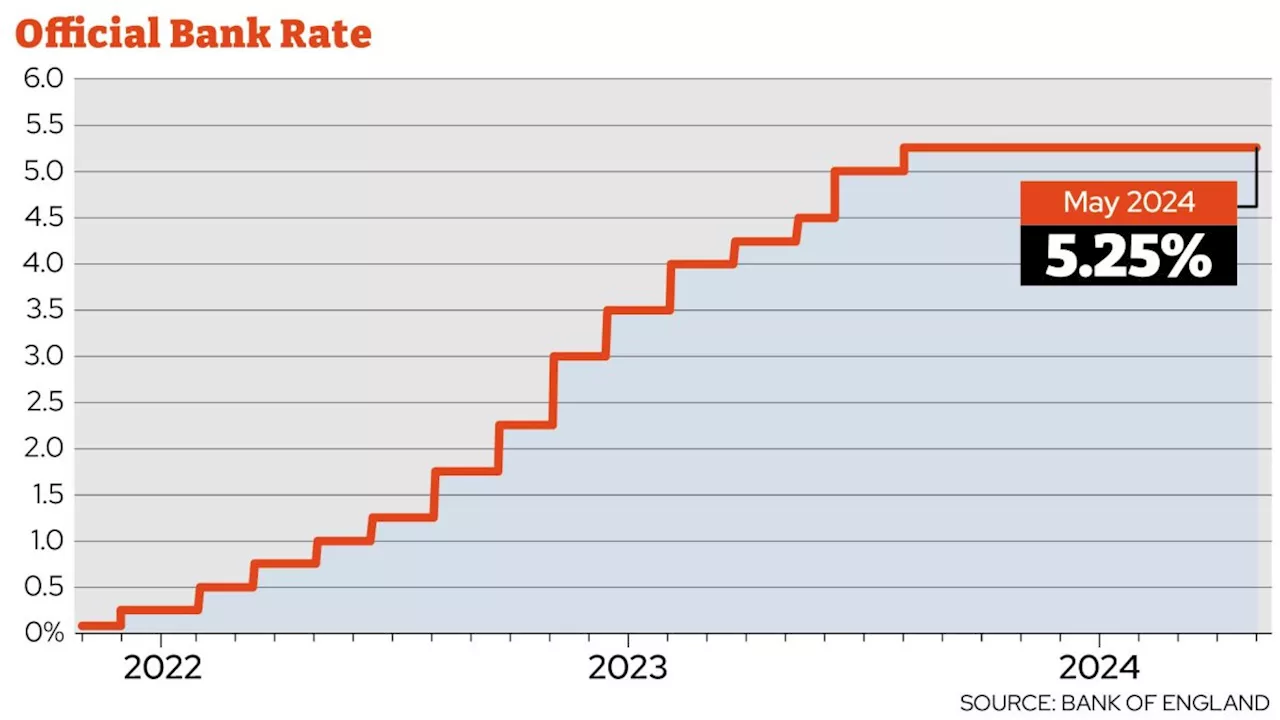

Interest rates are locked in at a 16-year high

The Bank of England decided today to keep the base rate of interest at a 16-year high of 5.25 per cent, in order to bring inflation down to the government target of 2%. But for first-time buyers and new homeowners, this has effectively locked in an extra £290 per month on top of mortgage payments.

But following half a year of high interest rates, the cost to borrowers of loans and mortgages has ballooned, increasing the number of home repossessions due to debt defaults in the UK by 36% in just the first quarter of 2024. With data showing many homeowners paying an extra £3480 per year to keep up with their mortgage due to the high rate of interest, today's announcement by the central bank will have done little to ease the worries of mortgage holders.

Bank Of England Your Money Money Interest Rates

Ireland Latest News, Ireland Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Interest rates held at 5.25% but Bank of England ‘optimistic’ about cutsThe central bank has again voted to freeze rates.

Interest rates held at 5.25% but Bank of England ‘optimistic’ about cutsThe central bank has again voted to freeze rates.

Read more »

The four key reasons why the Bank of England still won’t cut interest ratesDespite the Bank hinting rate cuts are to come, there are several key reasons why it won't do so yet

The four key reasons why the Bank of England still won’t cut interest ratesDespite the Bank hinting rate cuts are to come, there are several key reasons why it won't do so yet

Read more »

Bank of England holds interest rates at 16-year high of 5.25%The Bank of England has announced it is keeping the base rate of interest on hold at a 16-year-high of 5.25%.

Bank of England holds interest rates at 16-year high of 5.25%The Bank of England has announced it is keeping the base rate of interest on hold at a 16-year-high of 5.25%.

Read more »

Bank of England holds interest rates at 5.25% again – what it means for your moneyThe base rate has been held six times now since reaching its peak last year

Bank of England holds interest rates at 5.25% again – what it means for your moneyThe base rate has been held six times now since reaching its peak last year

Read more »

Bank of England not ready to cut interest rates, experts sayThe Bank of England’s Monetary Policy Committee (MPC), which sets the level of UK interest rates, will announce its latest decision on Tuesday

Read more »

Bank of England not yet ready to cut UK interest rates, experts sayThe Bank of England’s Monetary Policy Committee, which sets the level of UK interest rates, will announce its latest decision on Thursday.

Read more »