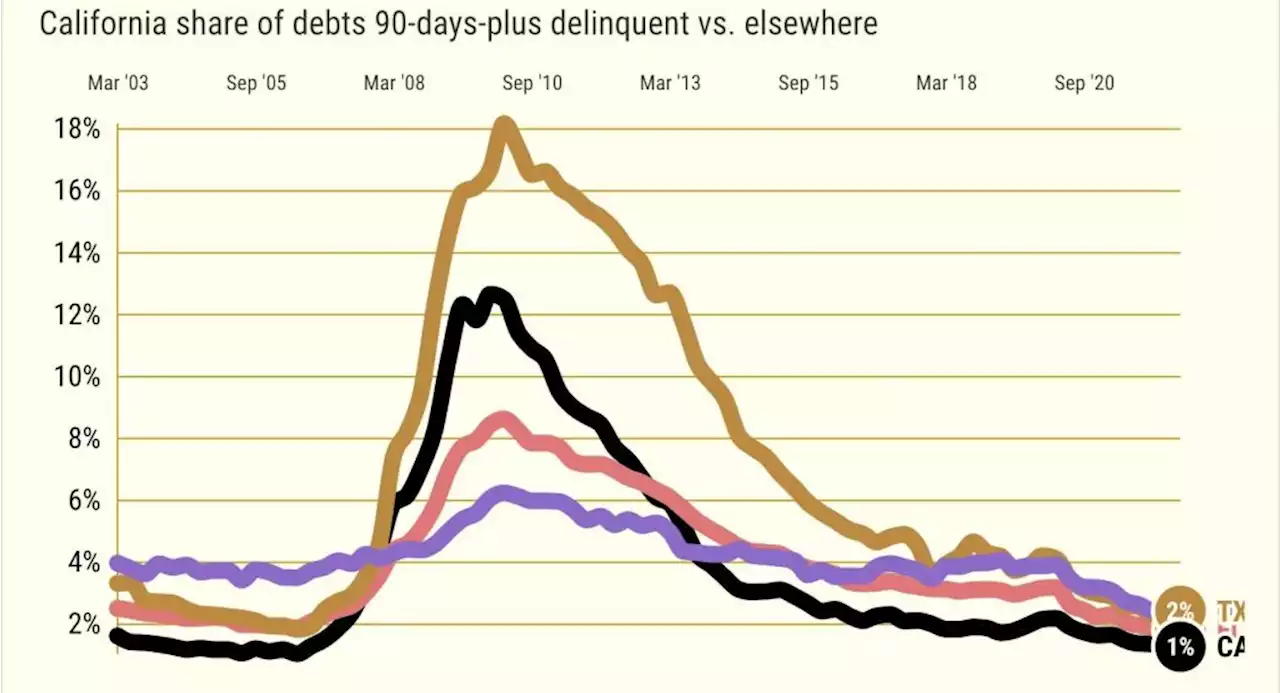

California late payers equal 1.9% of debt owed vs. 2.8% of Americans behind on repayment and 3.5% in Texas and Florida.

September 15, 2022 at 11:33 a.m.” digs into trends that may indicate economic and/or housing market troubles ahead.Californians may have huge debts, but they’re apparently making loan payments better than most Americans.The data includes the size and payments of consumer debts in 11 big states and the nation through June 2022 quarter. These stats look only at people with credit histories — a sizable but not complete slice of the population. Debt levels are tracked as a per-person average.

And that’s better than the national norm, which saw 1.81% of debts going unpaid in spring vs. 3.34% in 2015-19. Florida had 2.41% late in spring vs. 4.76% in 2015-19, while Texas was 2.44% late in spring vs. 3.80% in 2015-19.Let’s be honest, debt is an odd economic factor to track. Too little can be bad but too much is often troublesome.

And so far in the ever-surprising pandemic era, consumers across the nation have been improving repayments while borrowing aggressively. The state is no anomaly. Debt nationwide grew at a 5.3% annual pace in the pandemic era vs. 2.5% before. Texas? 7.3% pandemic growth vs. 4.4% before. Florida? 6.9% vs. 3.5%.

Ireland Latest News, Ireland Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

US national debt nears $31T: How it compares with other countriesAs the national debt continues to climb and approach an unprecedented $31 trillion, FOX Business compares U.S. government debt to that of other nations.

US national debt nears $31T: How it compares with other countriesAs the national debt continues to climb and approach an unprecedented $31 trillion, FOX Business compares U.S. government debt to that of other nations.

Read more »

Single mom who paid off $34K of debt empowers other single moms to face their debts'In a way, I saw myself becoming my mom...I saw how hard it was for her to take care of three kids when she did not really grasp how to properly manage her money.' 'I did not want to keep this pattern in rotation. It was literally up to me to break that.'

Single mom who paid off $34K of debt empowers other single moms to face their debts'In a way, I saw myself becoming my mom...I saw how hard it was for her to take care of three kids when she did not really grasp how to properly manage her money.' 'I did not want to keep this pattern in rotation. It was literally up to me to break that.'

Read more »

New report highlights ongoing problem with poverty in OhioIn a new report from OACAA, data shows how poverty continues to be a problem in the buckeye state, highlighting how housing, employment, childcare and student loan debt play a role.

New report highlights ongoing problem with poverty in OhioIn a new report from OACAA, data shows how poverty continues to be a problem in the buckeye state, highlighting how housing, employment, childcare and student loan debt play a role.

Read more »

Understanding the Risks of Buy Now, Pay Later AppsBuy now, pay later apps have appeal for cash-strapped college students, but they can be a slippery slope to debt if they’re not used responsibly.

Understanding the Risks of Buy Now, Pay Later AppsBuy now, pay later apps have appeal for cash-strapped college students, but they can be a slippery slope to debt if they’re not used responsibly.

Read more »

Gov. Gavin Newsom signs CARE Court legislationSan Francisco is one of seven California counties that must implement the CARECourt program by Oct. 1, 2023.

Gov. Gavin Newsom signs CARE Court legislationSan Francisco is one of seven California counties that must implement the CARECourt program by Oct. 1, 2023.

Read more »