Cryptoassets and big tech may soon face the kind of financial caps imposed on overheating housing markets, EU financial stability watchdogs suggested today. jackschickler reports.

European Union banks could face stricter limits on their crypto holdings to prevent the burgeoning market in virtual assets upending the financial system, the bloc’s financial-stability watchdog said.

The ESRB suggested that those tools should extend beyond banking into other institutions, including new financial technology players, and large companies such as Meta and Google.Markets in Crypto Assets Regulation In a November consultation that closed recently, the European Commission asked whether supervisors need extra powers to tackle the financial stability risks of crypto-based products and competitive pressures from the potential arrival of new fintech participants.

Ireland Latest News, Ireland Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

EU lawmakers set to tighten up on crypto transfersEuropean Union lawmakers were set on Thursday to back tougher safeguards for transfers of bitcoin and other cryptocurrencies, in the latest sign that regulators are tightening up on the freewheeling sector.

EU lawmakers set to tighten up on crypto transfersEuropean Union lawmakers were set on Thursday to back tougher safeguards for transfers of bitcoin and other cryptocurrencies, in the latest sign that regulators are tightening up on the freewheeling sector.

Read more »

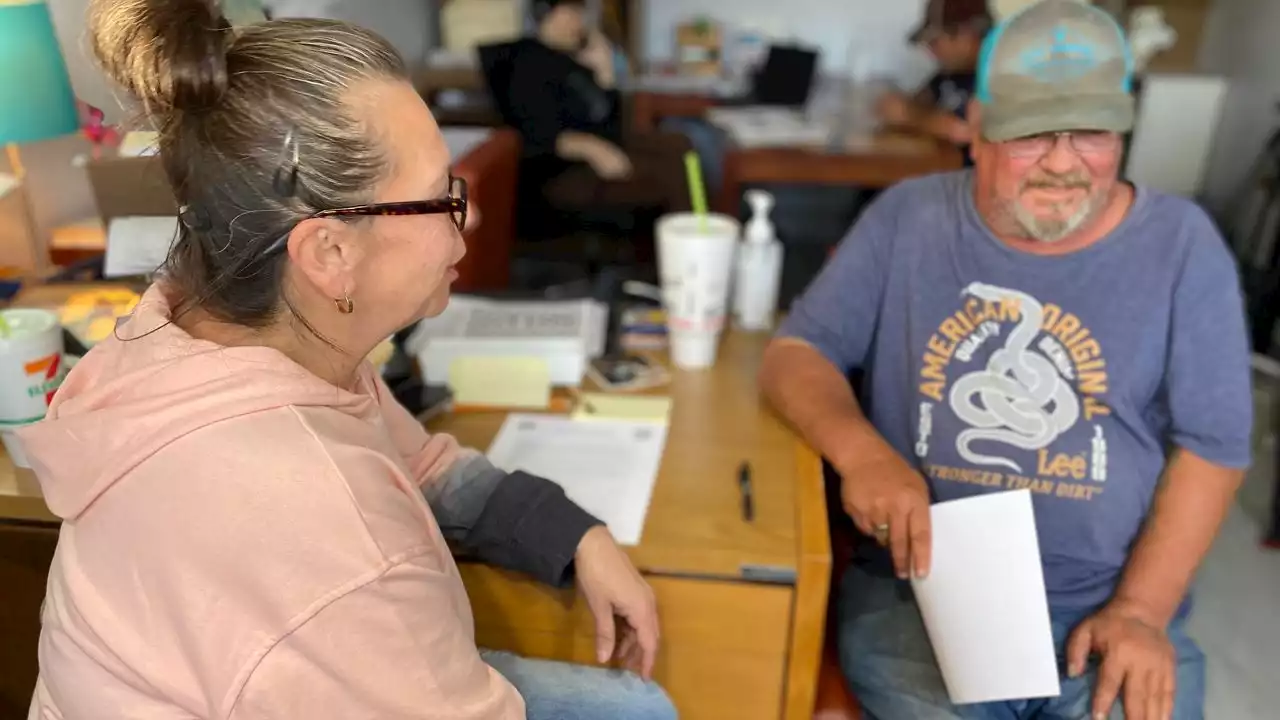

Renters at risk as local relief programs risk losing remaining fundsLocal emergency rent relief programs stand to lose nearly $100 million if unspent by March 31.

Renters at risk as local relief programs risk losing remaining fundsLocal emergency rent relief programs stand to lose nearly $100 million if unspent by March 31.

Read more »

UK's FCA Extends Temporary Registration Deadline for Select Crypto FirmsU.K. regulator TheFCA will extend its registration deadline for select crypto firms 'where strictly necessary.' By JamieCrawleyCD

Read more »

UK financial watchdog extends registration deadline for some crypto firmsThe United Kingdom’s financial regulator said “a small number of firms” in the crypto space will continue to have temporary registration status in the U.K. “where it is strictly necessary.”

UK financial watchdog extends registration deadline for some crypto firmsThe United Kingdom’s financial regulator said “a small number of firms” in the crypto space will continue to have temporary registration status in the U.K. “where it is strictly necessary.”

Read more »

Crypto Firms Weigh Options as UK Registration Deadline LoomsCrypto firms in the U.K. scramble for options as the deadline to receive permission from TheFCA looms. By JamieCrawleyCD

Crypto Firms Weigh Options as UK Registration Deadline LoomsCrypto firms in the U.K. scramble for options as the deadline to receive permission from TheFCA looms. By JamieCrawleyCD

Read more »