Different tax and reporting regimes apply depending on the nature of the investment fund

Most people dealing with unit fund investments will see the fund manager deduct tax on gains every eight years and return the details to Revenue.

It has long been a bone of contention with the industry which argues that the existing tax regime is inimical to investors and cuts into their returns. The Minister has indicated that he is open to change but his officials will no doubt be mindful of any dramatic change on the current tax revenue that investment funds deliver for the exchequer.

This provides for the payment of tax to Revenue on any individual’s gains by the fund managers on the eighth anniversary of the investment, and every subsequent eighth anniversary. That rate has changed over the years but Revenue’s justification has always been that the rate is set to account for the fact that Revenue leaves the money untouched for that eight-year period to maximise investor returns at a cost to the exchequer over that time.

To further complicate things, some funds are not taxed at source and these will be your responsibility. These include offshore funds where you may have an obligation to account for tax on the same deemed disposal basis. In this case, you would do that through your tax return in the relevant year.

Ireland Latest News, Ireland Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

SMBC profits hit record €423m as revenue surgesAmount excludes insurance settlement tied to aircraft leased to Russian carriers

SMBC profits hit record €423m as revenue surgesAmount excludes insurance settlement tied to aircraft leased to Russian carriers

Read more »

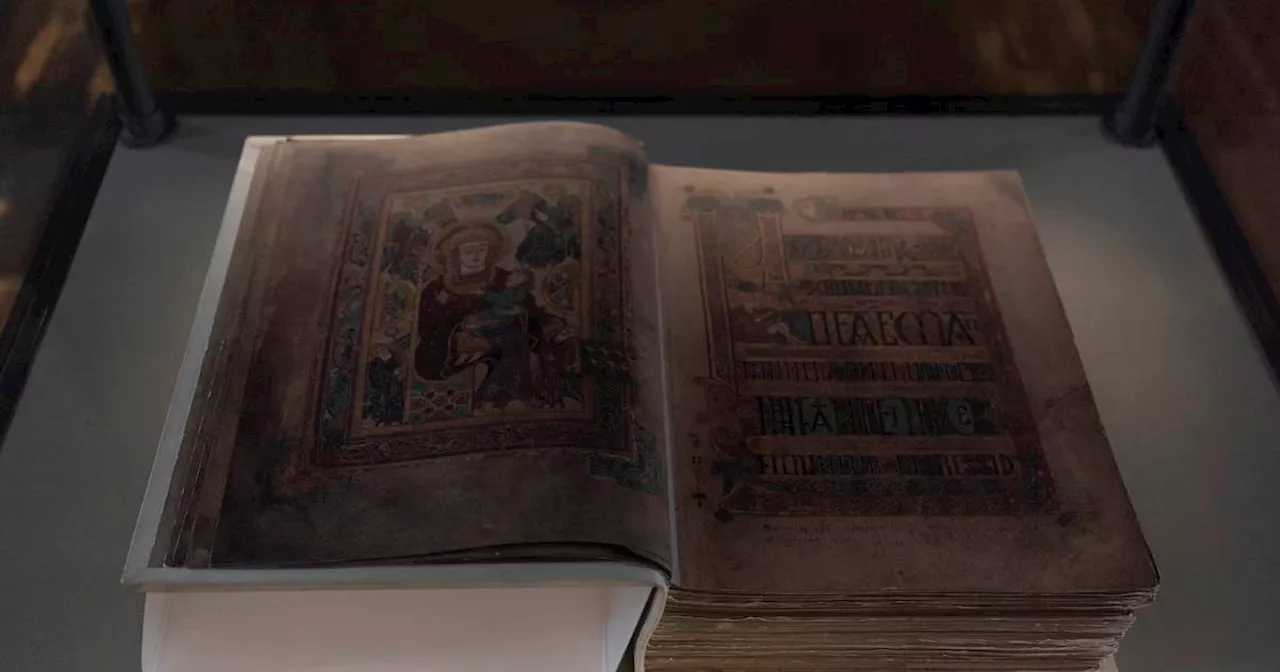

Book of Kells exhibition revenue increases to more than €20mSome 900,000 visitors attended display of manuscript at Trinity College Dublin, up from 740,000 the previous year

Book of Kells exhibition revenue increases to more than €20mSome 900,000 visitors attended display of manuscript at Trinity College Dublin, up from 740,000 the previous year

Read more »

Office of Ombudsman for Children pays more than €100,000 in settlement with RevenuePayments made in respect of staff incorrectly categorised as contractors rather than employees

Office of Ombudsman for Children pays more than €100,000 in settlement with RevenuePayments made in respect of staff incorrectly categorised as contractors rather than employees

Read more »

C&C expects to report net revenue of €1.6bn for full yearDrinks group C&C expects to report net revenue of €1.6bn for the full 2024 year, which would be down 2% on last year.

Read more »

Automotive industry supplier lost tax battle with RevenueBusiness paid a cumulative €14m to employee benefit trusts

Automotive industry supplier lost tax battle with RevenueBusiness paid a cumulative €14m to employee benefit trusts

Read more »

Revenue seizes more than €600k worth of nitrous oxide in two operationsA total of €647,000 worth of nitrous oxide was seized by Revenue officers at Dublin Port in two recent operations

Revenue seizes more than €600k worth of nitrous oxide in two operationsA total of €647,000 worth of nitrous oxide was seized by Revenue officers at Dublin Port in two recent operations

Read more »