The Irish government is reviewing its housing policy in an attempt to address the ongoing housing crisis, particularly the affordability of rental accommodation. Key areas under scrutiny include the Residential Tenancies Zone (RPZ) system and the introduction of tax incentives for private residential sector investors.

The Irish government is facing mounting pressure to address the ongoing housing crisis , particularly the affordability of rental accommodation for young people. While the government insists it has the right policies in place, recent data paints a concerning picture. New home completions, which reached a post-crash high of 33,000 in 2023, actually fell back to 30,330 units in 2024, falling short of government targets.

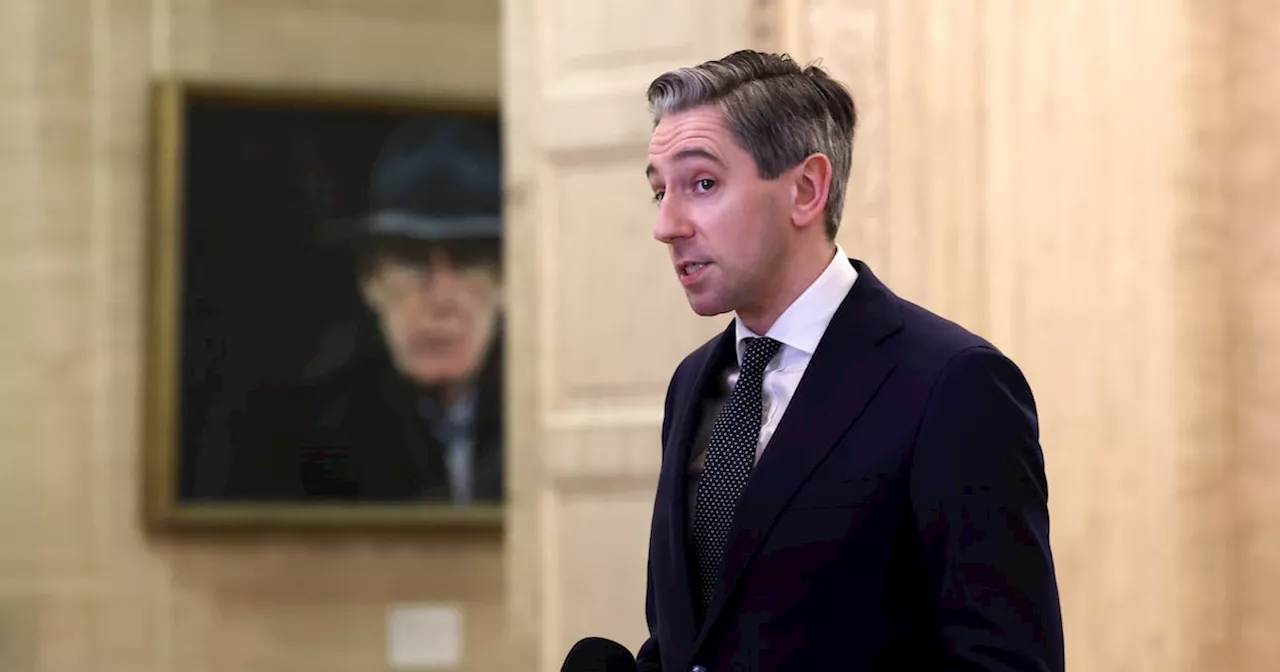

This decline is attributed to a number of factors, including a slowdown in apartment development and a decrease in private investment. The government has acknowledged the need to encourage more private sector involvement in the housing market, signaling a review of its current housing policy.A key area under scrutiny is the Residential Tenancies Zone (RPZ) system, which caps annual rent increases at 2 percent or the rate of inflation, whichever is lower. The system, which is due to expire this year, is seen as a deterrent by some private investors, while others argue it is crucial for keeping already high rents in check. There are also discussions about introducing tax incentives specifically for private residential sector investors to stimulate investment in the market.Taoiseach Micheál Martin has stated the need to create a more stable environment for investment, particularly in the apartment sector, which has seen a significant decline in recent years. Foreign funds, which had been driving a boom in apartment construction, particularly in Dublin, have pulled back due to higher interest rates and other economic factors. The government is aware of the urgency to address the situation and is working with industry stakeholders to find solutions. However, any changes to the RPZ system or introduction of tax breaks will likely face political resistance, given concerns about affordability for renters already struggling with high costs. The government faces a balancing act between encouraging investment and ensuring that rent increases remain manageable for tenants

Housing Crisis Ireland Rent Controls RPZ Investment Tax Breaks Apartment Development

Ireland Latest News, Ireland Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Housing experts pour freezing cold water on Government’s narrative of turbocharged housing supply‘Little chance’ of achieving plan to build 300,000 new homes by 2030

Housing experts pour freezing cold water on Government’s narrative of turbocharged housing supply‘Little chance’ of achieving plan to build 300,000 new homes by 2030

Read more »

Housing Targets Missed as New Home Construction Falls ShortIreland fell short of its ambitious housing targets for 2024 with a 6.7% decrease in new home construction compared to the previous year. Despite government predictions of exceeding targets, data from the Central Statistics Office (CSO) reveals that only 30,300 homes were completed, significantly below the 33,000 target set by the Housing for All plan. The apartment sector experienced the most significant decline, with completions dropping by 24%. Sinn Féin housing spokesperson, Eoin Ó Broin, criticized the government's housing targets and attributed the slowdown in construction to a lack of necessary reforms in both public and private housing delivery.

Housing Targets Missed as New Home Construction Falls ShortIreland fell short of its ambitious housing targets for 2024 with a 6.7% decrease in new home construction compared to the previous year. Despite government predictions of exceeding targets, data from the Central Statistics Office (CSO) reveals that only 30,300 homes were completed, significantly below the 33,000 target set by the Housing for All plan. The apartment sector experienced the most significant decline, with completions dropping by 24%. Sinn Féin housing spokesperson, Eoin Ó Broin, criticized the government's housing targets and attributed the slowdown in construction to a lack of necessary reforms in both public and private housing delivery.

Read more »

Players sharing bedrooms as housing crisis bites for League of Ireland clubsDetails emerging of worsening situation as clubs and players struggle ahead of 2025 season.

Players sharing bedrooms as housing crisis bites for League of Ireland clubsDetails emerging of worsening situation as clubs and players struggle ahead of 2025 season.

Read more »

Ireland's Most and Least Affordable Counties for Homebuyers: A Look at the Housing MarketThis article explores the current trends and future projections in the Irish housing market, focusing on the affordability of different counties for homebuyers. It highlights Leitrim, Longford, and Donegal as the most affordable options, while Dublin emerges as the least affordable. The article also analyzes the potential for future price increases in various counties, particularly Wicklow, which is predicted to see the most significant surge by 2030.

Ireland's Most and Least Affordable Counties for Homebuyers: A Look at the Housing MarketThis article explores the current trends and future projections in the Irish housing market, focusing on the affordability of different counties for homebuyers. It highlights Leitrim, Longford, and Donegal as the most affordable options, while Dublin emerges as the least affordable. The article also analyzes the potential for future price increases in various counties, particularly Wicklow, which is predicted to see the most significant surge by 2030.

Read more »

HBFI Loan Approvals Surge, Fueling Ireland's Housing SupplyHome Building Finance Ireland (HBFI) experienced a dramatic increase in loan approvals in 2024, reaching €2.7 billion, a 61% jump from the previous year. This surge in funding supports the construction of new homes across Ireland, addressing the ongoing housing shortage.

HBFI Loan Approvals Surge, Fueling Ireland's Housing SupplyHome Building Finance Ireland (HBFI) experienced a dramatic increase in loan approvals in 2024, reaching €2.7 billion, a 61% jump from the previous year. This surge in funding supports the construction of new homes across Ireland, addressing the ongoing housing shortage.

Read more »

Ireland Central Bank Governor Sees 'Worrying Signs' in Euro Area Growth, Favors Dropping 'Restrictive' Policy LanguageCentral Bank of Ireland governor Gabriel Makhlouf cited 'worrying signs' in the euro zone economy, particularly growth concerns, influencing the ECB's decision to cut interest rates for the fifth time since July. While acknowledging the ECB is increasingly focused on growth, Makhlouf emphasized the commitment to bringing inflation down to 2 percent. He also suggested dropping the 'restrictive' policy language at the next meeting.

Ireland Central Bank Governor Sees 'Worrying Signs' in Euro Area Growth, Favors Dropping 'Restrictive' Policy LanguageCentral Bank of Ireland governor Gabriel Makhlouf cited 'worrying signs' in the euro zone economy, particularly growth concerns, influencing the ECB's decision to cut interest rates for the fifth time since July. While acknowledging the ECB is increasingly focused on growth, Makhlouf emphasized the commitment to bringing inflation down to 2 percent. He also suggested dropping the 'restrictive' policy language at the next meeting.

Read more »