Ireland’s stringent banking rules should allow the country’s main lenders to evade any significant turbulence arising from the forced sale of Credit Suisse and the collapse of Silicon Valley Bank, according to analysts.

Since the financial crash of 2008, Irish banks are required to hold significantly higher amounts of

capital than their peers across the EU, which is a policy often criticised by some in the financial sector.

Ireland Latest News, Ireland Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Chambers Ireland: Ireland’s planning system is a roadblock hindering climate progressChambers Ireland, a body that represents Irish businesses, has said that Ireland’s current planning system hinders progress on climate change

Chambers Ireland: Ireland’s planning system is a roadblock hindering climate progressChambers Ireland, a body that represents Irish businesses, has said that Ireland’s current planning system hinders progress on climate change

Read more »

IRFU set to bank over €5m from Ireland’s Grand Slam successPlayers will share between €1.5m and €2m which is paid out on an appearance-based sliding scale

IRFU set to bank over €5m from Ireland’s Grand Slam successPlayers will share between €1.5m and €2m which is paid out on an appearance-based sliding scale

Read more »

Bank of Ireland slapped with €750k fine after data breachesThe issue involved Bank of Ireland’s 365 system and allowed customers to access accounts that weren't theirs

Bank of Ireland slapped with €750k fine after data breachesThe issue involved Bank of Ireland’s 365 system and allowed customers to access accounts that weren't theirs

Read more »

North-South Interconnector moves to 'next phase' following reviewThe North-South Interconnector is moving to the 'next phase' following a review, EirGrid has said.

North-South Interconnector moves to 'next phase' following reviewThe North-South Interconnector is moving to the 'next phase' following a review, EirGrid has said.

Read more »

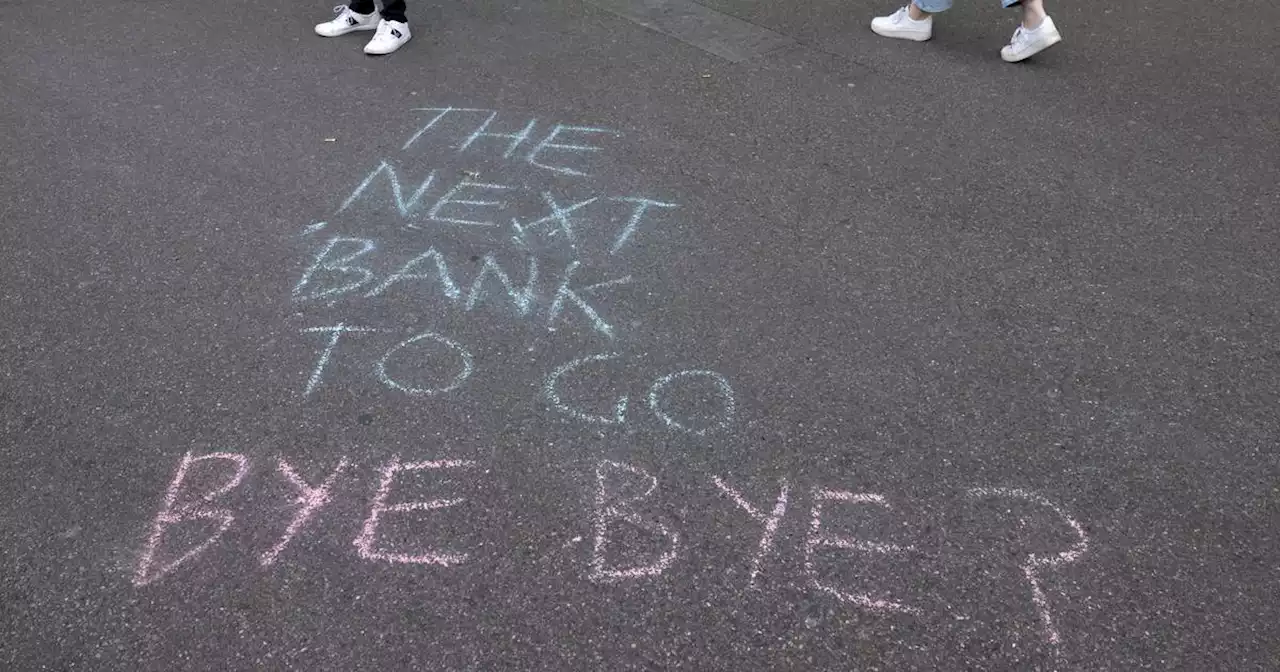

Are more ‘financial flameouts’ coming?Analysts say volatility in bank share prices resembles past eras of generalised market stress

Are more ‘financial flameouts’ coming?Analysts say volatility in bank share prices resembles past eras of generalised market stress

Read more »

What do you think of the new Ireland soccer jersey?Ireland launch their new jersey, which will be worn for the first time on Wednesday night against Latvia.

What do you think of the new Ireland soccer jersey?Ireland launch their new jersey, which will be worn for the first time on Wednesday night against Latvia.

Read more »