Reporting requirements for third-party business transactions over $600, enacted by the American Recovery Act of 2021, have been delayed until 2023.

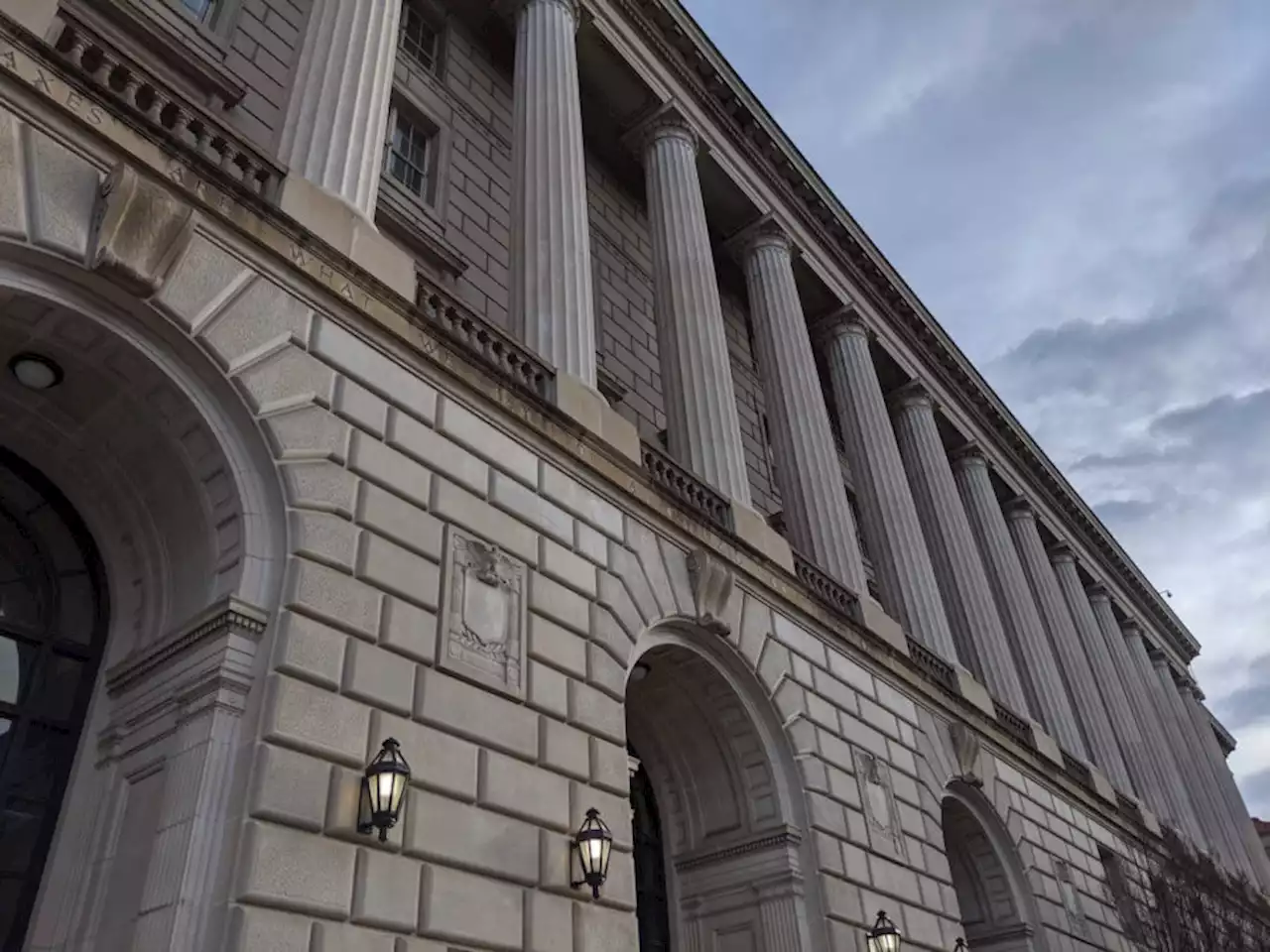

IRS to delay $600 payment platform reporting threshold, calls 2022 "transition period"The IRS is delaying new requirements that require third-party settlement organizations like PayPal and Venmo to lower the business transaction reporting threshold to $600.The Internal Revenue Service is delaying new requirements that require third-party settlement organizations like PayPal and Venmo to report transactions that exceed a minimum threshold of $600 in aggregate payments until next year.

Introduced as part of the American Rescue Plan of 2021, the regulation significantly lowered the tax reporting threshold for business transactions to $600 per year from a previous level of"more than 200 transactions per year, exceeding an aggregate amount of $20,000." The IRS said that care must be taken “to help ensure that 1099-Ks are only issued to taxpayers who should receive them.”on transition guidance for broker reporting on digital assets, the IRS said that brokers will not be required to report additional information with respect to dispositions of digital assets until final regulations are issued.

Ireland Latest News, Ireland Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

WSJ News Exclusive | IRS Delays Gig-Tax Filing Rule for Side Hustles of More Than $600The Internal Revenue Service gives millions of Americans a one-year reprieve on new 1099-K tax-reporting requirements, offering relief to users of e-commerce platforms such as eBay, Etsy and Airbnb.

WSJ News Exclusive | IRS Delays Gig-Tax Filing Rule for Side Hustles of More Than $600The Internal Revenue Service gives millions of Americans a one-year reprieve on new 1099-K tax-reporting requirements, offering relief to users of e-commerce platforms such as eBay, Etsy and Airbnb.

Read more »

IRS Halts Controversial New Rule Requiring Gig Workers To Report $600 PaymentsThe $600 threshold faced widespread criticism for being too low, potentially putting millions of lower income workers in the crosshairs of IRS targeting.

IRS Halts Controversial New Rule Requiring Gig Workers To Report $600 PaymentsThe $600 threshold faced widespread criticism for being too low, potentially putting millions of lower income workers in the crosshairs of IRS targeting.

Read more »

After Congress Fails To Act, IRS Delays Onerous New 1099-K Reporting For Payment PlatformsThe law, requiring payment platforms like PayPal to file Form 1099-Ks for anyone receiving over $600 (down form $20,000) threatened mass taxpayer confusion.

After Congress Fails To Act, IRS Delays Onerous New 1099-K Reporting For Payment PlatformsThe law, requiring payment platforms like PayPal to file Form 1099-Ks for anyone receiving over $600 (down form $20,000) threatened mass taxpayer confusion.

Read more »

The 10 Best Board Games of 2022It's been another great year for board games. keithlaw helps you sort through all the new releases with his list of the best new games of 2022.

The 10 Best Board Games of 2022It's been another great year for board games. keithlaw helps you sort through all the new releases with his list of the best new games of 2022.

Read more »