The rush into the sector was predicated on the continuous availability of cheap capital

Subjective approaches and difficult to verify inputs can result in large variations in private investment valuations. Values derived frombetween different in-house managed funds or with other asset managers are affected by potential conflicts of interest as manager remuneration is based on investment values and performance. Infrequent valuations mean prices lag behind changing market conditions, resulting in real gains and losses for investors buying into or withdrawing money from funds.

Third, private equity originally focused on long holding period investments purchased with substantial borrowings in traditional industries that offered undervalued shares, strong cash flows, low operating risk and the potential forConsistent with industrial shifts outside of property and infrastructure, transactions are not secured by hard assets such as real estate, plant or equipment but supported by intellectual property such as internet platforms orThe latter are harder to value and more...

Today, investments are frequently held through tiers of funds, some with borrowings from banks or private providers.of private equity loans and non-bank credit display familiar opacity and exacerbate leverage in the system. Falls in asset value anywhere can create instability elsewhere within the financial system.

The recent history of highly managed money supply, low interest rates and artificially suppressed volatility encouraged investors to take on often unquantifiable and poorly understood hazards. The rush into private assets was predicated on the continuous availability of cheap capital as a sustainable investment strategy. It also ignored the immutable positive correlation between risk and return.

To crib from US actor and humourist Will Rogers, it seems that financial markets advance by finding new ways to lose money, which is surprising given that the old ways continue to work just as well.

Ireland Latest News, Ireland Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Still no help with bills after Boris Johnson attends energy firm crisis talksBoris Johnson told energy firms that any ‘significant fiscal decisions’ to address soaring bills would be a matter for the next prime minister

Still no help with bills after Boris Johnson attends energy firm crisis talksBoris Johnson told energy firms that any ‘significant fiscal decisions’ to address soaring bills would be a matter for the next prime minister

Read more »

Five demands to tackle the energy crisis — and how likely they are to happeni looks at the main options available to help those who will be hardest hit by the energy price cap rise, with the help of GoCompare.com’s energy spokesperson, Gareth Kloet

Five demands to tackle the energy crisis — and how likely they are to happeni looks at the main options available to help those who will be hardest hit by the energy price cap rise, with the help of GoCompare.com’s energy spokesperson, Gareth Kloet

Read more »

Are emerging economies on the verge of another “lost decade”?“In some ways, the best bet for emerging markets might be a recession in the US,” economistmeg tells birdyword on this week’s “Money Talks”

Are emerging economies on the verge of another “lost decade”?“In some ways, the best bet for emerging markets might be a recession in the US,” economistmeg tells birdyword on this week’s “Money Talks”

Read more »

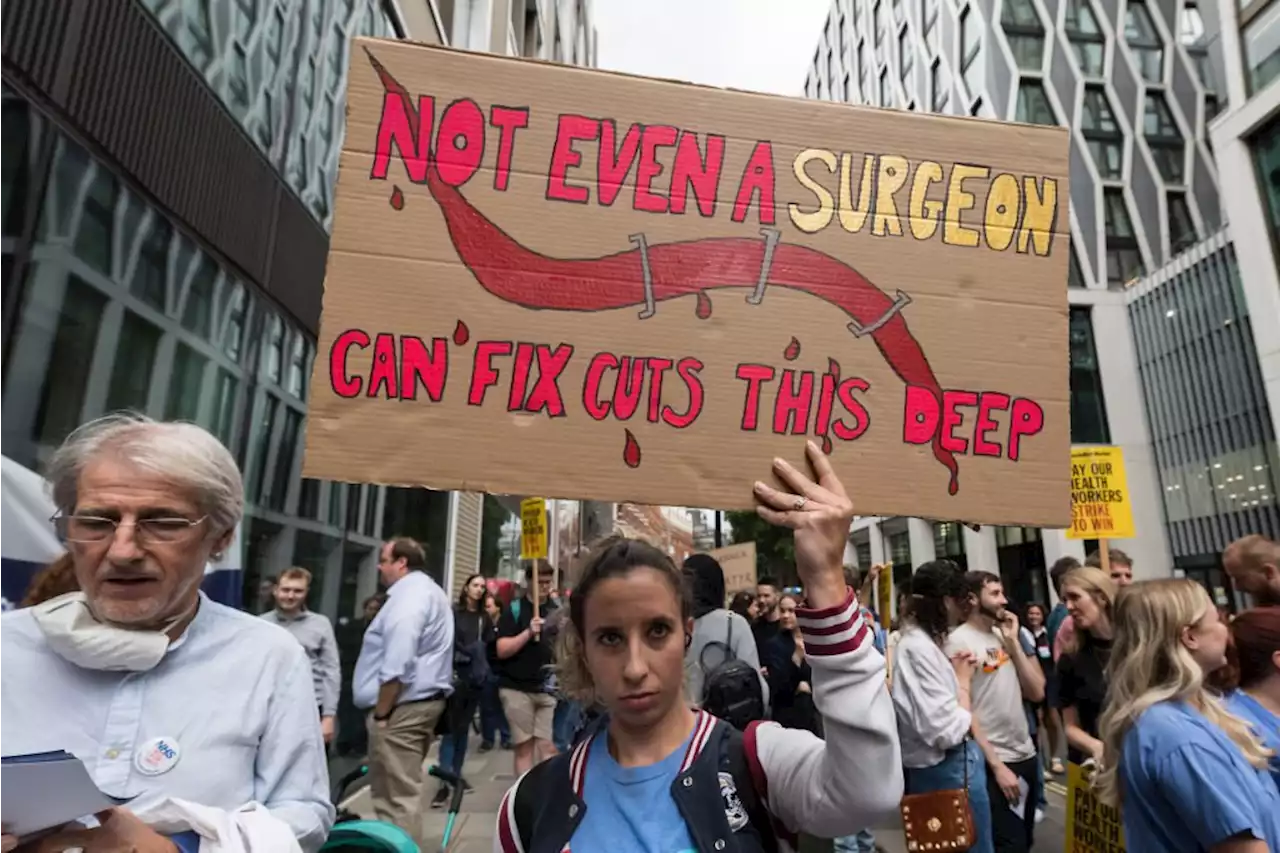

Inflation means big NHS cuts, and that's just the start of the Government's problemsInflation means big NHS cuts, and that's just the start of the Government's problems 🔵 Will_Tanner for ipaperviews

Inflation means big NHS cuts, and that's just the start of the Government's problemsInflation means big NHS cuts, and that's just the start of the Government's problems 🔵 Will_Tanner for ipaperviews

Read more »

Raikkonen tests Trackhouse NASCAR Next Gen car at VIR ahead of Cup debutKimi Raikkonen completed his first NASCAR Next Gen car laps at VIRginia International Raceway today. The 2007 F1 champion is set to make his Cup Series debut for TeamTrackhouse at Watkins Glen next weekend. ⬇️

Raikkonen tests Trackhouse NASCAR Next Gen car at VIR ahead of Cup debutKimi Raikkonen completed his first NASCAR Next Gen car laps at VIRginia International Raceway today. The 2007 F1 champion is set to make his Cup Series debut for TeamTrackhouse at Watkins Glen next weekend. ⬇️

Read more »