S&P 500 hits highest since mid-February in upper-4400s as investors await remarks from Fed’s Powell By Frank_Macro SP500 Equities

pite arguably negative news flow over the weekend – a lack of progress in Russo-Ukraine peace talks, chatter about an EU embargo on Russianexports – the S&P 500 is trading about 0.1% higher in the 4470 area after a dip back towards 4450 earlier in the session was bought into. The index managed to hit its highest level since mid-February at 4480.

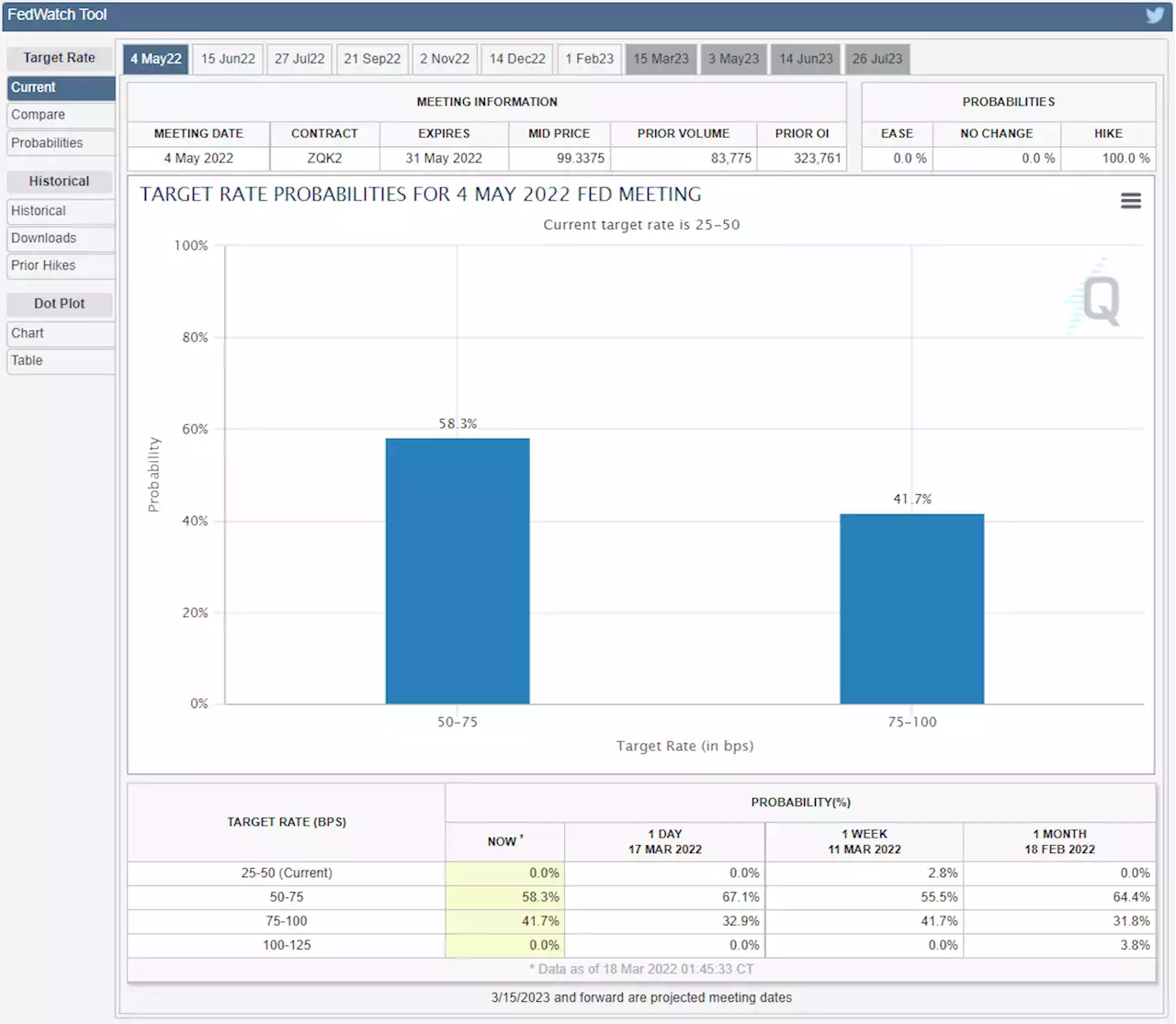

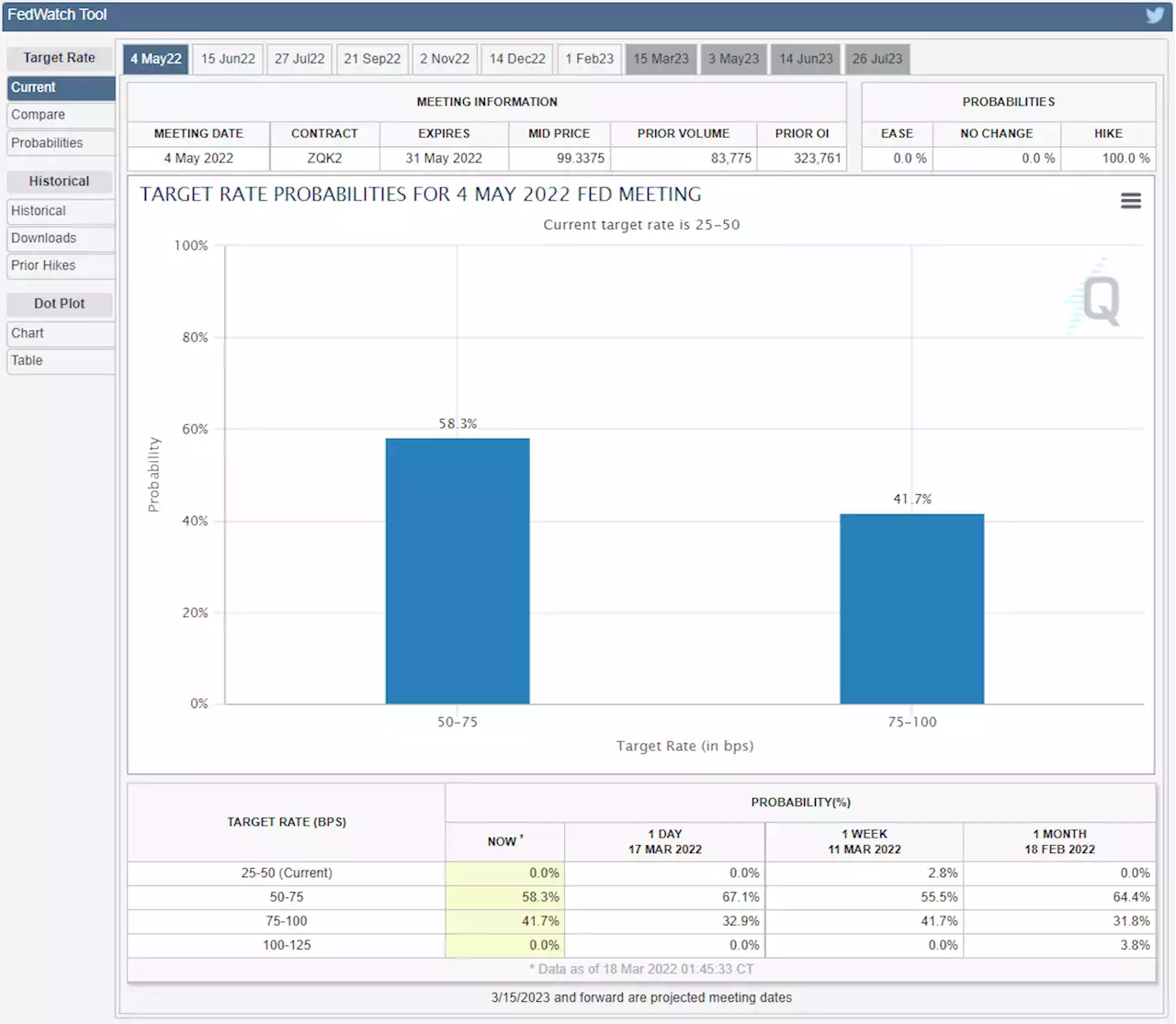

Powell is unlikely to deviate from this script, meaning there aren’t likely to be any meaningful trading opportunities in response to his comments. Nonetheless, the big man might give some more details on things like the Fed’s ideas about how it might conduct Quantitative Tightening, so will be worth keeping an eye on.

In terms of the other major US indices, the Nasdaq 100 is currently flat in the 14,400 area, after a dip back to 14,250 earlier in the day was bought. The Dow is an underperformer as a result of steep downside in Boeing’s share price, which makes up just under 4.0% of the index’s weighting after a 737-800 jet crashed in China. The index is currently trading about 0.5% lower, though for now remains well supported above the 34,500 level.

Index or VIX was last down at its lowest level in more than one month in the 23.00s, down about half a point on the day.

Ireland Latest News, Ireland Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

S&P 500 Forecast: Post-Fed Rally Leads to Break of Monthly Opening RangeThe improvement in risk appetite may keep the S&P 500 index afloat over the coming days as the Federal Reserve appears to be in no rush to winddown its balance sheet. Get your weekly equities forecast from DavidJSong here:

S&P 500 Forecast: Post-Fed Rally Leads to Break of Monthly Opening RangeThe improvement in risk appetite may keep the S&P 500 index afloat over the coming days as the Federal Reserve appears to be in no rush to winddown its balance sheet. Get your weekly equities forecast from DavidJSong here:

Read more »

Treasury yields rise as investors await remarks by Fed's Powell, monitor Russia-Ukraine warTreasury yields rise Monday as traders await remarks by Federal Reserve Chairman Jerome Powell and continue to monitor developments in the Russia-Ukraine war.

Treasury yields rise as investors await remarks by Fed's Powell, monitor Russia-Ukraine warTreasury yields rise Monday as traders await remarks by Federal Reserve Chairman Jerome Powell and continue to monitor developments in the Russia-Ukraine war.

Read more »

S&P 500 Forecast: Post-Fed Rally Leads to Break of Monthly Opening RangeThe improvement in risk appetite may keep the S&P 500 index afloat over the coming days as the Federal Reserve appears to be in no rush to winddown its balance sheet. Get your weekly equities forecast from DavidJSong here:

S&P 500 Forecast: Post-Fed Rally Leads to Break of Monthly Opening RangeThe improvement in risk appetite may keep the S&P 500 index afloat over the coming days as the Federal Reserve appears to be in no rush to winddown its balance sheet. Get your weekly equities forecast from DavidJSong here:

Read more »

U.S. Stocks Extend Yearslong Winning StreakInvestors are piling into U.S. stocks, betting that the world’s largest economy will hold up better than those in other regions where the outlook has dimmed amid war or rising Covid cases.

U.S. Stocks Extend Yearslong Winning StreakInvestors are piling into U.S. stocks, betting that the world’s largest economy will hold up better than those in other regions where the outlook has dimmed amid war or rising Covid cases.

Read more »

Analysis: For Fed's Powell, 2019 remains the touchstone for a post-pandemic economyFederal Reserve Chair Jerome Powell has often pointed to the months before the pandemic as a heyday for the U.S. economy, and he is counting on an across-the-board return to economic conditions circa 2019 to help win a fight against high inflation without sparking higher unemployment.

Analysis: For Fed's Powell, 2019 remains the touchstone for a post-pandemic economyFederal Reserve Chair Jerome Powell has often pointed to the months before the pandemic as a heyday for the U.S. economy, and he is counting on an across-the-board return to economic conditions circa 2019 to help win a fight against high inflation without sparking higher unemployment.

Read more »

Shares in Asia-Pacific Rise as Investors Await Release of China's Benchmark Lending Rate; Oil Jumps 2%China’s latest one-year loan prime rate is set to be out at 9:15 a.m. HK/SIN on Monday, with little expectations for change, according to a Reuters survey.

Shares in Asia-Pacific Rise as Investors Await Release of China's Benchmark Lending Rate; Oil Jumps 2%China’s latest one-year loan prime rate is set to be out at 9:15 a.m. HK/SIN on Monday, with little expectations for change, according to a Reuters survey.

Read more »