Two years into the role, O’Connor will oversee two new sovereign wealth funds with aim of capturing and investing windfall tax revenues

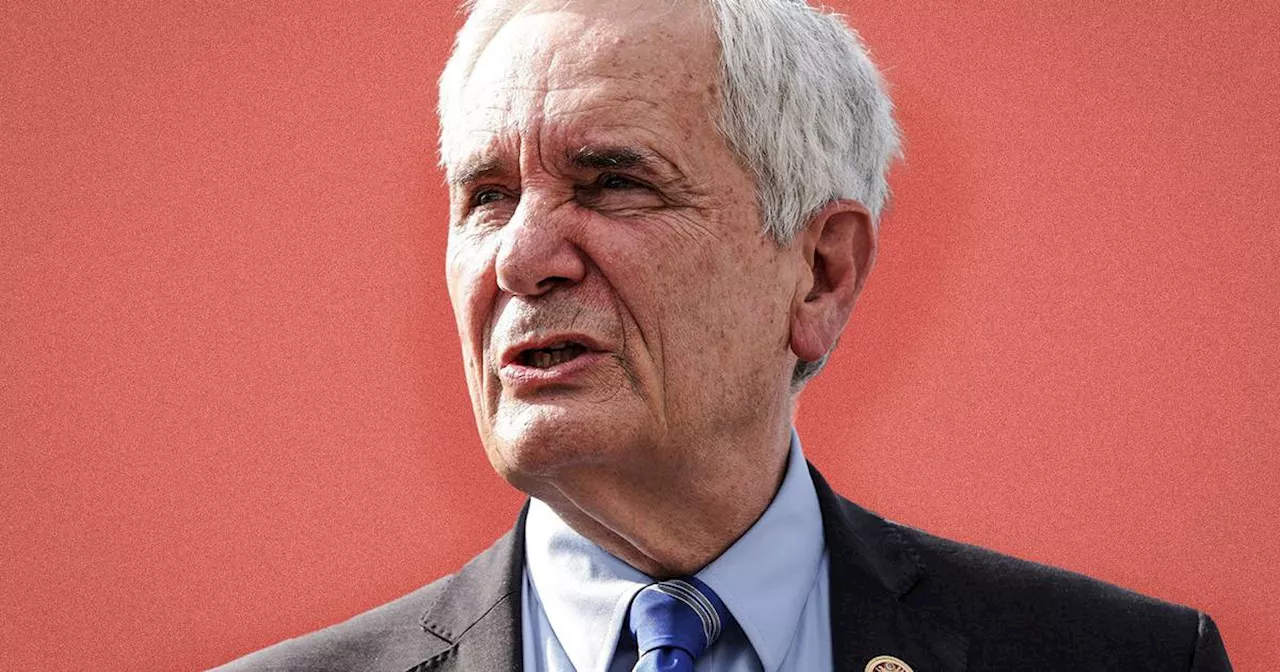

NTMA chief executive Frank O’Connor says Ireland's credit rating now is very strong although we are still a way off regaining triple-A status with ratings agencies. Photograph: Bryan O’Brien, is intent on keeping him busy for the rest of the year, as he plans to hand over an initial €10 billion for the NTMA to manage in two new sovereign wealth funds – the Future Ireland Fund and Infrastructure, Climate and Nature Fund – with the aim of capturing and investing windfall tax revenues.

The new mandate will see the NTMA, founded in 1990 to manage Government funding and borrowings after the debt crisis in the 1980s, grow to six business units, also including the State Claims Agency that manages personal injury claims on behalf of the State, the Ireland Strategic Investment Fund , National Development Finance Agency and the NewEra advisory body to the Government on State-owned companies.

“We also have a core engine around things like IT and HR . So, when the State needed to set up Nama 15 years ago at short notice, for example, you had an obvious vehicle that you could place it into.” The Kildare native joined AIB’s capital markets business in 1990 after graduating with a business studies degree from Trinity College Dublin. He studied accounting at night and qualified in 1993, though immediately afterwards he ventured out of the finance unit and into the bank’s dealing room.

“The benefit for me in that job was that you were now the one going to the assets and liabilities management committee and sitting in to give updates to the management board,” he says of his time there. “Whereas in Dublin there were lots of senior managers, so you wouldn’t have gotten that type of exposure as early.

Moody’s, one of the world’s leading credit ratings agencies, had downgraded Ireland’s creditworthiness to ‘junk’ – or sub-investment – grade in a humiliating move in the middle of 2011.Keeping in contact with investors paid off, with the NTMA managing to get a €5.2 billion bond sale away in July 2012, a few weeks after dipping its toes into the short-term debt markets by selling €500 million of three-month treasury bills.

Following a number of upgrades from the main ratings agencies over the past decade, as the state of the banks and the country’s finances improved, Ireland is back in the AA club at Standard & Poor’s, Fitch and Moody’s, the highest standing it has had with all three since 2009.“It could do. But the bar is higher after the global financial crisis,” O’Connor says.

Ireland’s 10-year bonds are currently trading at a little over 2.9 per cent. While that’s higher than the 2.5 per cent rate attached to German bonds – seen as the benchmark for euro zone debt – similar notes of the so-called “semi-core” group that the NTMA could only dream of joining a decade ago, including Belgium, Austria and France, are all currently above 3 per cent.

Jack-Chambers Michael-Mcgrath Nama

Ireland Latest News, Ireland Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Philip Nolan v Science Foundation Ireland: The dispute that has rocked Ireland’s science communityCase likely to hinge on issue of whether fair procedures were applied when board of science funding body summarily dismissed director general

Philip Nolan v Science Foundation Ireland: The dispute that has rocked Ireland’s science communityCase likely to hinge on issue of whether fair procedures were applied when board of science funding body summarily dismissed director general

Read more »

Horse Racing Ireland 'shocked and appalled' at abuses exposed in Ireland's only horse abattiorAgriculture Minister Charlie McConalogue said ‘no stone will be left unturned in making sure the full rigours of the law are applied’.

Horse Racing Ireland 'shocked and appalled' at abuses exposed in Ireland's only horse abattiorAgriculture Minister Charlie McConalogue said ‘no stone will be left unturned in making sure the full rigours of the law are applied’.

Read more »

Ireland fans react as Heimir Hallgrimsson appointed new Ireland managerPlenty of fans have reacted with surprise to the Icelandic's appointment.

Ireland fans react as Heimir Hallgrimsson appointed new Ireland managerPlenty of fans have reacted with surprise to the Icelandic's appointment.

Read more »

NTMA has €27bn of cash and liquid assets on hand at end JuneReserves will reduce its borrowing requirement in coming years, agency says

NTMA has €27bn of cash and liquid assets on hand at end JuneReserves will reduce its borrowing requirement in coming years, agency says

Read more »

Strong increase in June consumer sentiment surveyThe consumer mood improved this month, according to the latest Credit Union Consumer Sentiment Survey, on the back of lower fuel costs and an ECB rate cut.

Read more »

Biden appears to have weakened internal Democratic sentiment leaning towards new candidateParty held behind-closed-doors caucus meeting on Tuesday at which elected members aired views on whether Biden should be confirmed as presidential nominee

Biden appears to have weakened internal Democratic sentiment leaning towards new candidateParty held behind-closed-doors caucus meeting on Tuesday at which elected members aired views on whether Biden should be confirmed as presidential nominee

Read more »