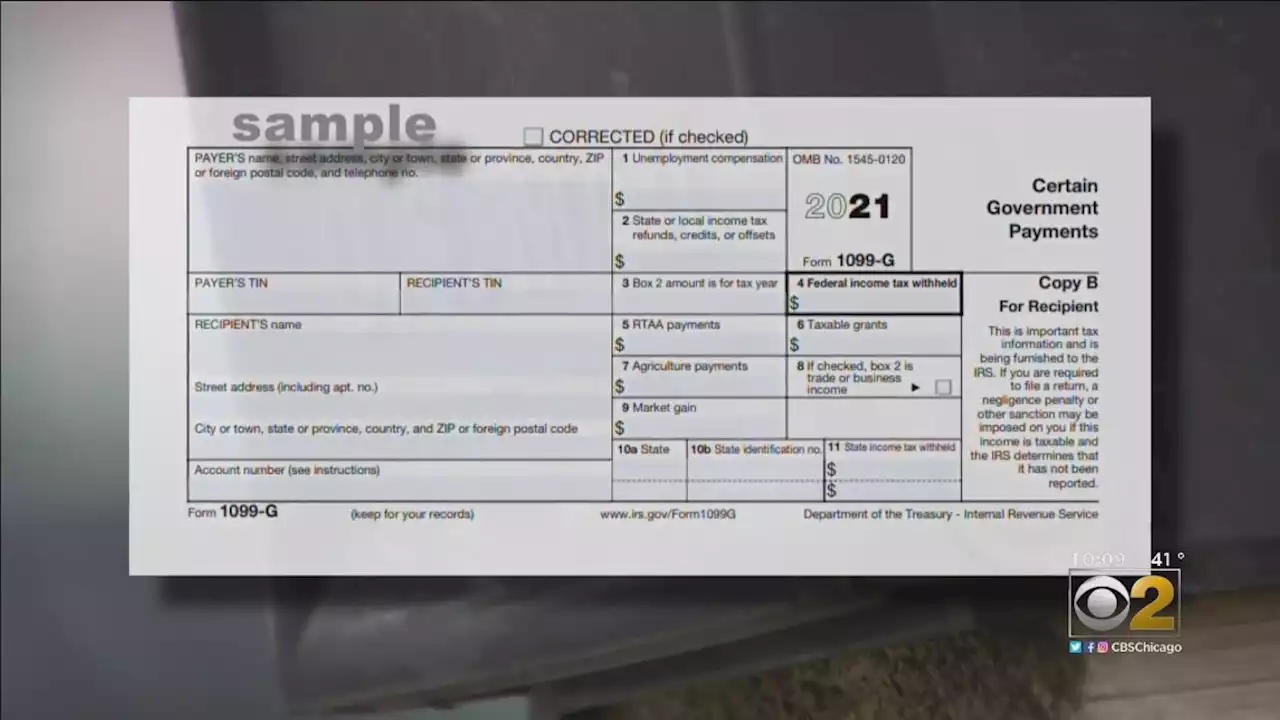

It’s tax time – and as some begin filing, they are finding out they're victims of fraud after someone applied for unemployment in their name.

. If a claimant did not receive UI benefits in 2021, yet still received a 1099-G form from IDES, this may indicate that a fraudulent claim was filed in their name. Such victims should contact IDES at 244-5631, and follow the prompts to schedule a callback in the correct queue. IDES representatives will return calls on a first-in, first-out basis to ensure the fraudulent claim is shut down, and to address the 1099-G form.

Meanwhile, thousands are still waiting for help on this issue on 1099-G related issues. Many have complained they can’t get a hold of the 1099-G when they need it to report unemployment benefits for tax purposes., the security measure implemented by the state to keep fraudsters out. But ILogin is keeping people like who need the form out too.

Per our most recent public records request to the state, more than 9,000 people were waiting for calls back from IDES on 1099-G-related issues., connecting you every day with the information you or a loved one might need about the jobs market, and helping you remove roadblocks to getting back to work.

We’ll keep uncovering information every day to help this community get back to work, until the job crisis passes. CBS 2 has several helpful items right here on our website, including a look at