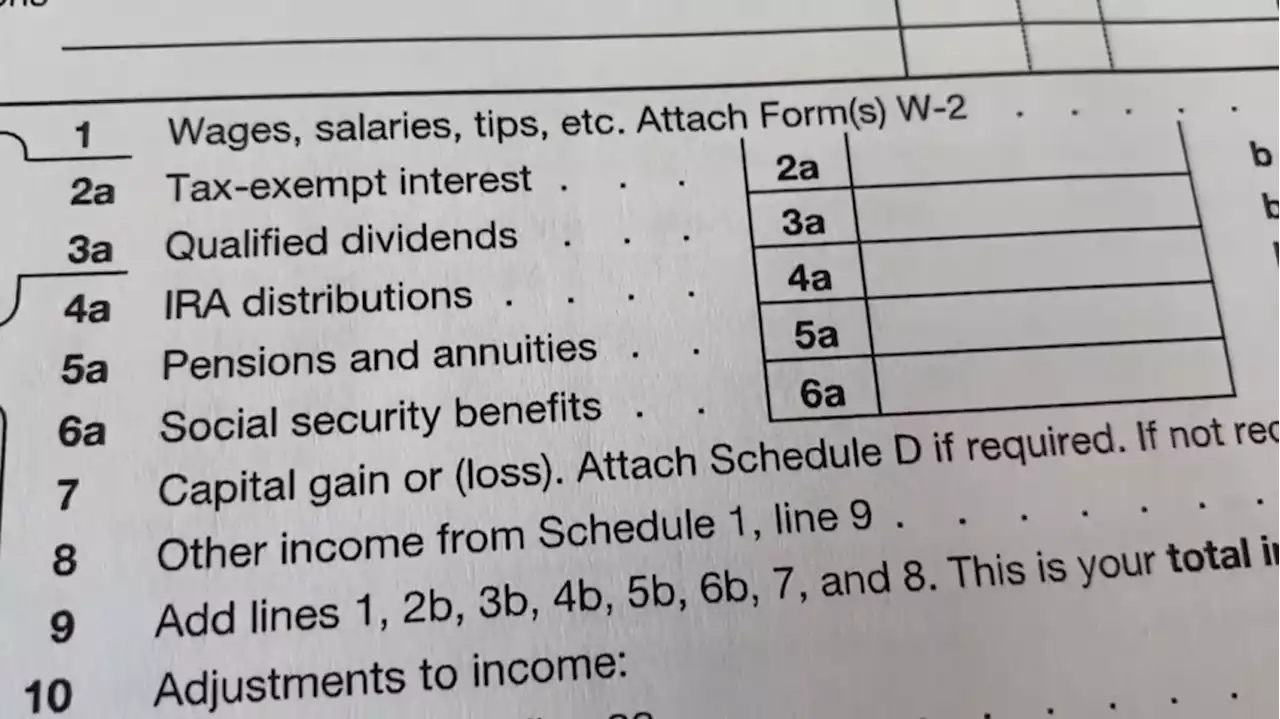

If you're counting on your refund this year, start adjusting your expectations.

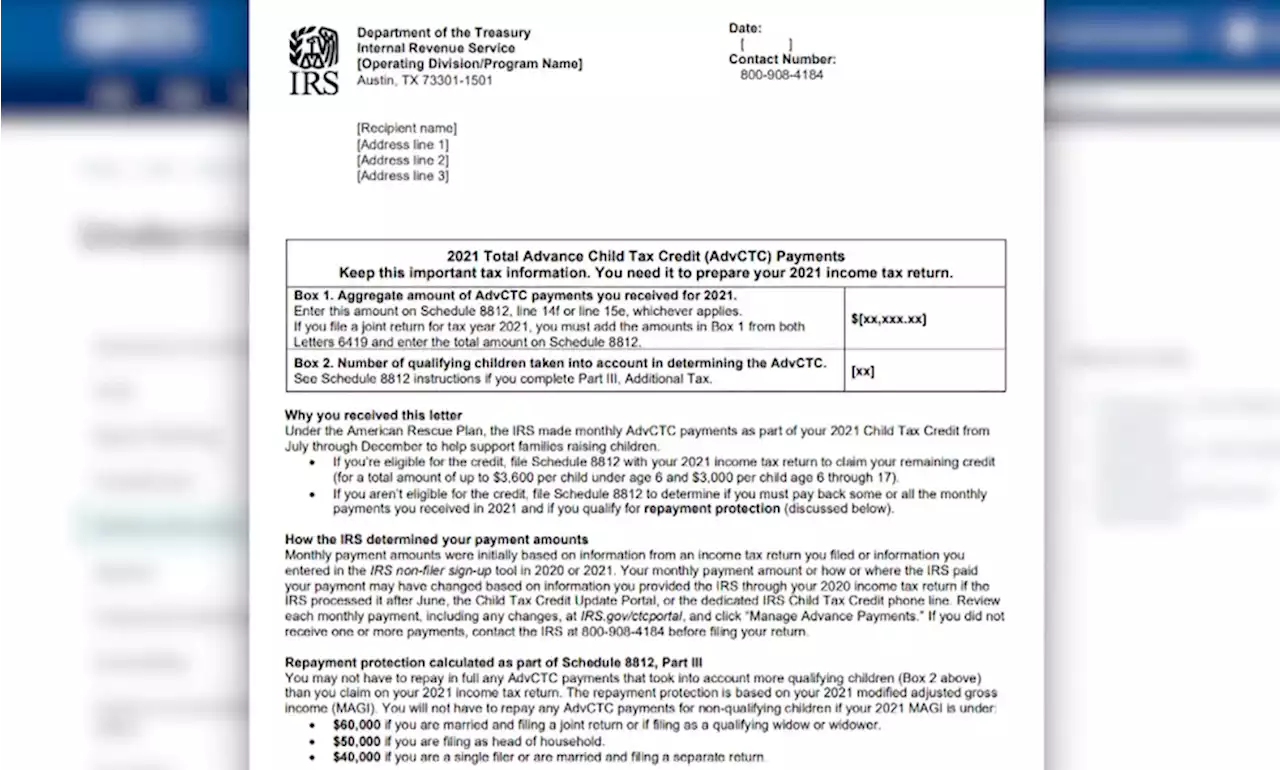

The child tax credit could end up costing some taxpayers even more: Anyone who received an advanced payment under this credit but didn't actually qualify for it will end up owing the IRS that money back.

"The IRS isn't smart enough to realize or didn't look into the date of birth, so they started dishing out $1,500 to my client through the advanced tax payments," Cyr explained. Now, the IRS will require taxpayers to repay the advanced payment if they were not actually eligible for it. That money will be deducted from your refund—but if it ends up being more than your refund can cover, you'll have to pay the rest back to the IRS directly.

"IRS employees are working hard to deliver a successful 2022 tax season while facing enormous challenges related to the pandemic," IRS Commissionersaid in a statement."There are important steps people can take to ensure they avoid processing delays and get their tax refund as quickly as possible. We urge people to carefully review their taxes for accuracy before filing.

If there are no issues with your tax return, you should receive your refund within 21 days of filing electronically if you choose direct deposit. However, the IRS does note that the law prohibits it from issuing refunds that involve the earned income tax credit or additional child tax credit before mid-February."The law provides this additional time to help the IRS stop fraudulent refunds from being issued," the agency states on its website.

Ireland Latest News, Ireland Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

IRS warns some taxpayers may have received incorrect Child Tax Credit letterThe issue could create tax refund delays for parents if they rely on faulty information to complete their tax returns.

IRS warns some taxpayers may have received incorrect Child Tax Credit letterThe issue could create tax refund delays for parents if they rely on faulty information to complete their tax returns.

Read more »

The IRS faces backlogs from last year as a new tax filing season beginsThe IRS is 'in the roughest shape it's been in in 50 years,' says former commissioner Mark Everson. The agency, he says, is understaffed, has more work than it can handle and is underfunded.

The IRS faces backlogs from last year as a new tax filing season beginsThe IRS is 'in the roughest shape it's been in in 50 years,' says former commissioner Mark Everson. The agency, he says, is understaffed, has more work than it can handle and is underfunded.

Read more »

Taxpayers, brace yourselves: Tax filing season starts amid IRS crisis, COVID-related complicationsU.S. taxpayers, brace yourselves because tax filing season starts Monday and you can expect the task to be more cumbersome than usual this year.

Taxpayers, brace yourselves: Tax filing season starts amid IRS crisis, COVID-related complicationsU.S. taxpayers, brace yourselves because tax filing season starts Monday and you can expect the task to be more cumbersome than usual this year.

Read more »

IRS warns parents not to toss important tax documentLetter 6419 from the IRS will help parents accurately report the amount of money they received upfront in 2021 for the child tax credit.

IRS warns parents not to toss important tax documentLetter 6419 from the IRS will help parents accurately report the amount of money they received upfront in 2021 for the child tax credit.

Read more »

City Launches 'Philadelphia Tax Center' Website Just In Time For Tax SeasonIf you're filing business taxes in Philadelphia, the city is using a new website. The Philadelphia Tax Center is up and running online.

City Launches 'Philadelphia Tax Center' Website Just In Time For Tax SeasonIf you're filing business taxes in Philadelphia, the city is using a new website. The Philadelphia Tax Center is up and running online.

Read more »

Taxpayers face overloaded IRS as filing season opens MondayU.S. taxpayers, brace yourselves because tax filing season starts Monday and you can expect the task to be more cumbersome than usual this year.

Taxpayers face overloaded IRS as filing season opens MondayU.S. taxpayers, brace yourselves because tax filing season starts Monday and you can expect the task to be more cumbersome than usual this year.

Read more »