The Deliberate Defaulters scheme flags up when a person or business has made at least one deliberate default on more than £25,000.

HMRC has published its latest list of deliberate tax defaulters, which reveals which firms and business owners have had to pay financial penalties after failing to comply with their tax obligations.

The Deliberate Defaulters scheme flags up when a person or business has made at least one deliberate default on more than £25,000. The department puts out the full list on a regular basis, with updates coming every three months. Information is then deleted after a year. The policy is known as"naming and shaming".

The following information was published by the UK Government on September 26, and featured nearly 100 firms across the UK.

Ireland Latest News, Ireland Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

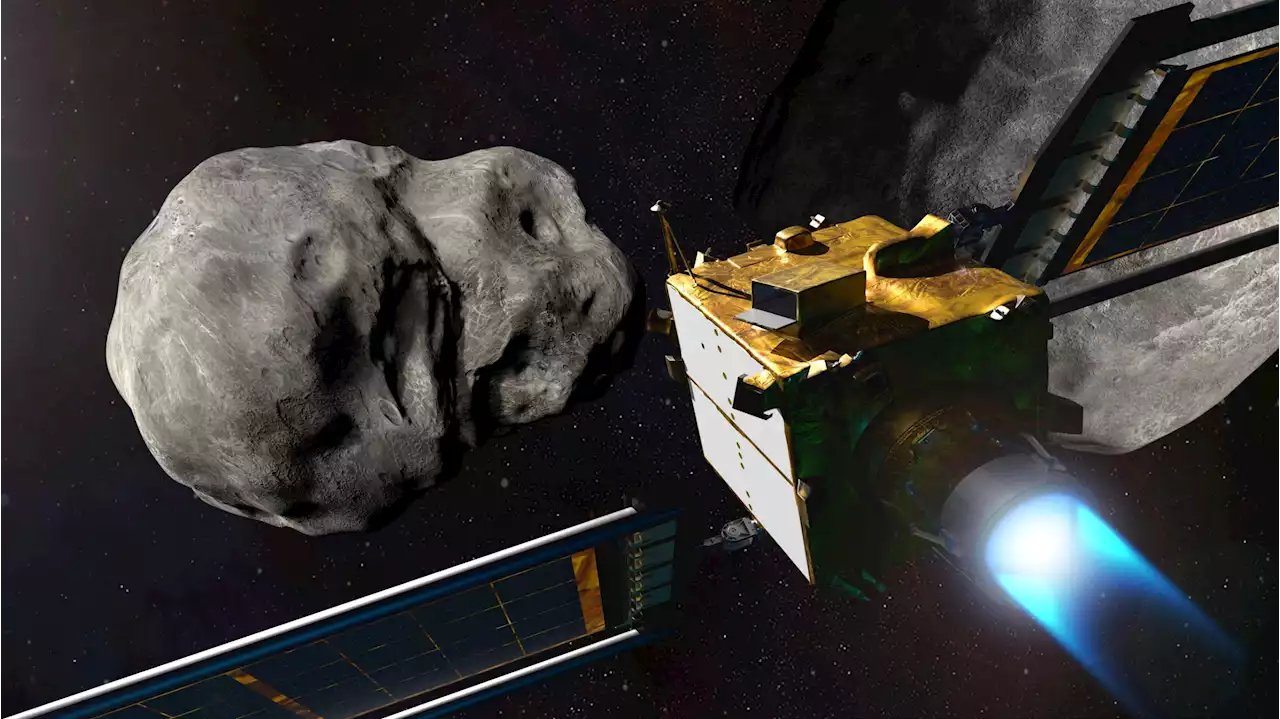

Nasa crashes Dart spacecraft into asteroid seven million miles from EarthBREAKING: Nasa crashes Dart spacecraft into asteroid seven million miles from Earth

Nasa crashes Dart spacecraft into asteroid seven million miles from EarthBREAKING: Nasa crashes Dart spacecraft into asteroid seven million miles from Earth

Read more »

Ex-Leeds Rhinos star Kevin Sinfield to embark on ‘toughest challenge yet’ in third MND charity runKevin Sinfield will run seven ultra marathons in seven days next month as he continues his campaign to raise money and awareness to help people impacted by motor neurone disease.

Ex-Leeds Rhinos star Kevin Sinfield to embark on ‘toughest challenge yet’ in third MND charity runKevin Sinfield will run seven ultra marathons in seven days next month as he continues his campaign to raise money and awareness to help people impacted by motor neurone disease.

Read more »

Dream job: Get paid to sample food and drink for Heineken SmartDispense- how to applyDream job: Get paid to sample food and drink for Heineken SmartDispense - how to apply

Dream job: Get paid to sample food and drink for Heineken SmartDispense- how to applyDream job: Get paid to sample food and drink for Heineken SmartDispense - how to apply

Read more »

Jail for ex-soldier who abused girl when he was 12Christopher Muir, of Grangemouth, targeted the child when she was aged between five and seven.

Jail for ex-soldier who abused girl when he was 12Christopher Muir, of Grangemouth, targeted the child when she was aged between five and seven.

Read more »