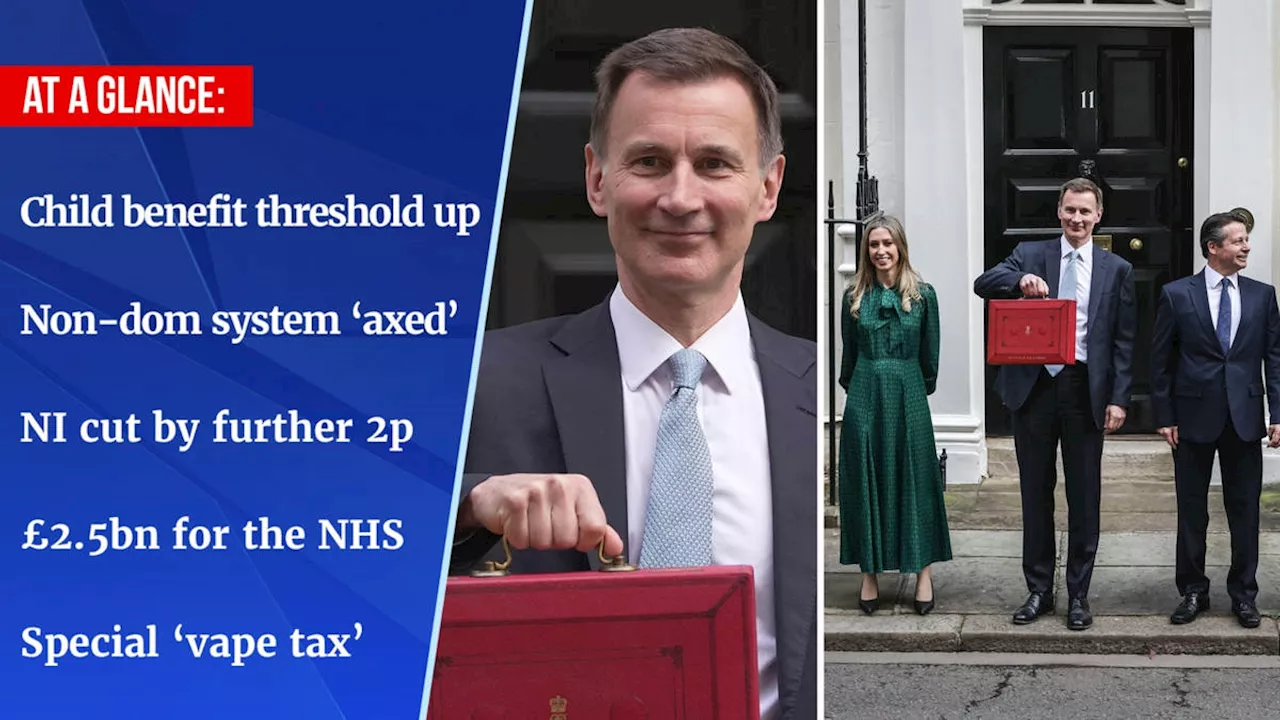

The Chancellor announced changes to Child Benefit in his Budget speech

Thousands of families are set to see a financial boost after changes to Child Benefit was announced in the latest Budget.

The reform has been claimed as a victory by Money Saving Expert Martin Lewis who has campaigned for changes to the high income tax charges in the Child Benefit system. Speaking to his followers on Twitter , he said: “I’m very happy about this”. He added that the Chancellor had told him that the change was in response to the Money Saving Expert campaign.

Currently, child benefit is only paid in full to households where no parent earns over £50,000. Once either parent starts to earn over this amount, they have to pay back 1% of the Child Benefit for every £100 of income earned above £50,000 a year. Under the new system, the lower limit will be lifted from £50,000 to £60,000 - which means any household where the highest earner is paid less than £60,000 will receive the full amount of Child Benefit.

The Chancellor announced there will be a consultation in the next two years on further reforms to Child Benefit, in particular looking at whether it should be based on household income, rather than on individual income.

Ireland Latest News, Ireland Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Dad saves £7k thanks to Martin Lewis' child benefit tipThe Money Saving Expert's tip saved one couple £7,000 – here's how you can do the same

Dad saves £7k thanks to Martin Lewis' child benefit tipThe Money Saving Expert's tip saved one couple £7,000 – here's how you can do the same

Read more »

Hunt hands £450 to millions and overhauls child benefit in 'tax-cutting' budgetChancellor Jeremy Hunt has announced a £450 boost for millions of workers and more help for parents in his Budget for 2024 - but there will be a crackdown on landlords, non-doms, vapers and smokers.

Hunt hands £450 to millions and overhauls child benefit in 'tax-cutting' budgetChancellor Jeremy Hunt has announced a £450 boost for millions of workers and more help for parents in his Budget for 2024 - but there will be a crackdown on landlords, non-doms, vapers and smokers.

Read more »

Check how much extra money you'll get with Child Benefit changesOur interactive calculator allows you to work out how much more you'll earn

Check how much extra money you'll get with Child Benefit changesOur interactive calculator allows you to work out how much more you'll earn

Read more »

'I earn £70,000 and can now get some child benefit payments'The BBC spoke to people with a range of earnings and household set-ups about how the Budget affects them.

'I earn £70,000 and can now get some child benefit payments'The BBC spoke to people with a range of earnings and household set-ups about how the Budget affects them.

Read more »

‘Child benefit change too slow and single parents lose,’ says mum on £65,000'We’re still in a cost-of-living crisis and two years is a long time to wait for this to be addressed'

‘Child benefit change too slow and single parents lose,’ says mum on £65,000'We’re still in a cost-of-living crisis and two years is a long time to wait for this to be addressed'

Read more »

Child Benefit Calculator shows how reforms will affect your familyReforms to Child Benefit follow a campaign by Money Saving Expert Martin Lewis

Child Benefit Calculator shows how reforms will affect your familyReforms to Child Benefit follow a campaign by Money Saving Expert Martin Lewis

Read more »