From the IRS to social security payments, here’s how a government shutdown might affect federal agencies and programs.

The IRS chief counsel, the official who interprets tax law for the agency, has consistently held that government workers can remain on the job

during shutdowns only if their duties protect the government, as opposed to individuals. That means ordinary taxpayers could be more exposed to financial hardship. For example, when the government shut down for 35 days in late 2018 and early 2019, employees from the Taxpayer Advocate Service, the agency’s internal consumer rights watchdog, could open mail only in search of checks payable to the government,Furthermore, at the start of that

shutdown, the roughly 12 percent of IRS employees who remained on the job couldn’t answer taxpayer phone calls, issue tax refunds, release liens and levies or complete a bevy of other taxpayer services, . As the shutdown dragged on closer to the filing season, which begins around Jan. 1 each year, the tax agency exemptedNaNThe roughly 1.3 million active-duty U.S. military service members would remain on the job without pay during a government shutdown. They would receive backpay after the shutdown ends, as would all the other federal workers forced to keep working during the period.

Ireland Latest News, Ireland Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

ANALYSIS: IRS Targeting More Supposedly 'High-Income' Americans Than AdvertisedEarlier this month, the IRS announced a new focus on squeezing 'high-income earners' as part of a 'historic effort to restore fairness in tax compl...

ANALYSIS: IRS Targeting More Supposedly 'High-Income' Americans Than AdvertisedEarlier this month, the IRS announced a new focus on squeezing 'high-income earners' as part of a 'historic effort to restore fairness in tax compl...

Read more »

IRS to target ‘unscrupulous' tax preparers amid crackdown of small business tax creditThe IRS has unveiled plans to crack down on tax preparers with “questionable practices” as it elevates scrutiny of a small business tax credit.

IRS to target ‘unscrupulous' tax preparers amid crackdown of small business tax creditThe IRS has unveiled plans to crack down on tax preparers with “questionable practices” as it elevates scrutiny of a small business tax credit.

Read more »

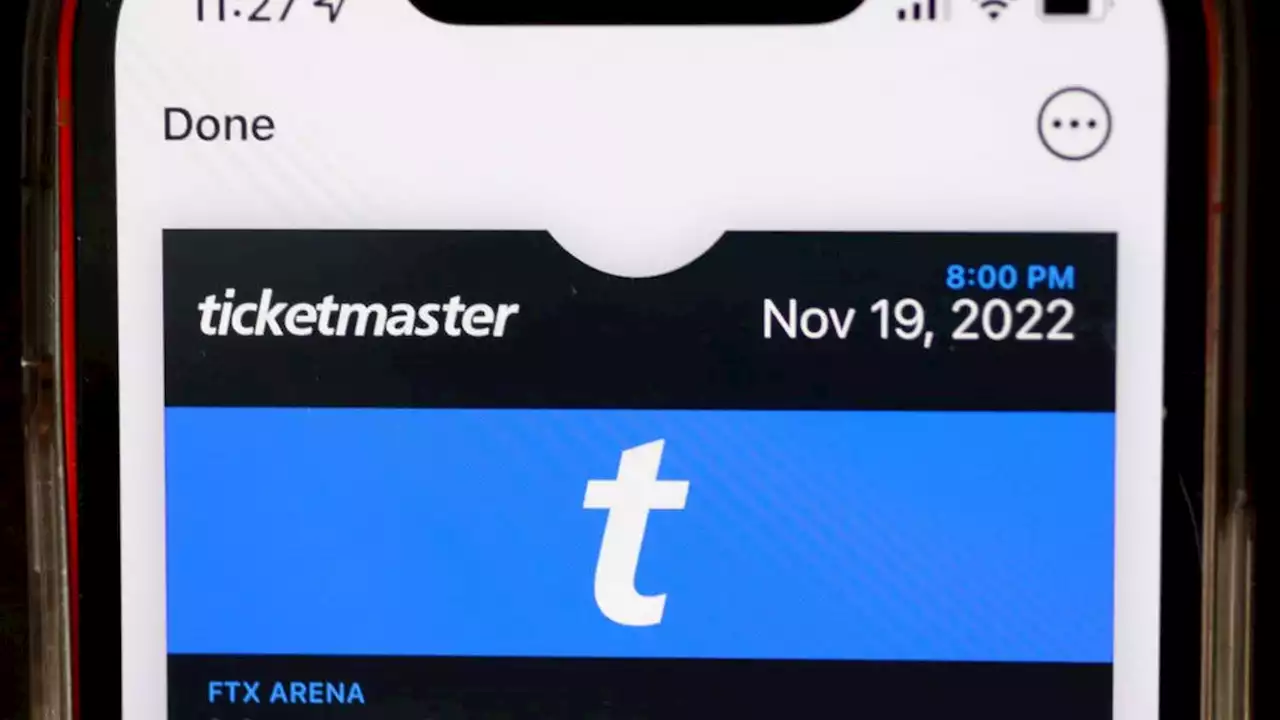

New IRS rule on reselling concert, sporting event tickets could impact large number of AmericansThe IRS is now tracking ticket resellers who made more than $600.

New IRS rule on reselling concert, sporting event tickets could impact large number of AmericansThe IRS is now tracking ticket resellers who made more than $600.

Read more »

IRS has important deadline reminder for some Alabama taxpayersThere’s an important tax deadline for people in parts of Alabama.

IRS has important deadline reminder for some Alabama taxpayersThere’s an important tax deadline for people in parts of Alabama.

Read more »

Ticketmaster, StubHub to report resales of over $600 to IRSIt doesn’t matter if the person reselling the tickets turned a profit, only that they sold more than $600, Fox Business reported. If they made a profit by selling it for more than they originally paid, the ticket seller would have to pay additional taxes.

Ticketmaster, StubHub to report resales of over $600 to IRSIt doesn’t matter if the person reselling the tickets turned a profit, only that they sold more than $600, Fox Business reported. If they made a profit by selling it for more than they originally paid, the ticket seller would have to pay additional taxes.

Read more »

Is IRS being dishonest in the name of fighting scams?The CARES Act was beneficial for most, yet it was targeted for scams by a few bad apples. The IRS is treating all small businesses as presumed guilty of deception.

Is IRS being dishonest in the name of fighting scams?The CARES Act was beneficial for most, yet it was targeted for scams by a few bad apples. The IRS is treating all small businesses as presumed guilty of deception.

Read more »