OPINION: The stock market’s prospects for the next 12 months are only modestly positive. That’s the conclusion of a market-timing model based on the ratio of gold’s price to platinum’s.

That’s the conclusion of a market-timing model based on the ratio of gold’s price GC00, +0.62% to platinum’s PL00, +1.91%. You might think it’s good news that equities’ 12-month potential is as promising now as it was in early 2021. But, in fact, most stocks have struggled since then. A relatively small number of large-cap stocks have propelled the S&P 500 SPX, +1.23% higher, and the Russell 2000 index RUT, +2.65% is 9.

During the COVID pandemic of the past two years the ratio has been highly volatile: It spiked in the wake of the market’s waterfall decline in March 2020, anticipating the market’s huge potential over the subsequent 12 months. Since then it fell, rose again, and over the past couple of months has fallen back.

The ‘war puzzle‘ You might find it surprising that the gold-platinum ratio has fallen in recent months, which suggests that risk has declined. Yet in February Russia invaded Ukraine and, according to some, the conflict could lead to World War III. That certainly seems like the very definition of heightened risk.

Regardless of whether this solves the “war puzzle,” the message of the gold-platinum based indicator with a good market-timing record is that the stock market’s potential over the next 12 months is only moderately positive.

Ireland Latest News, Ireland Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Here’s Why This Why Trailblazing Native American Politician Isn’t Accepting Her Colleague’s Apology“People should know how to conduct themselves. And if they don’t, then don’t run for office.”

Here’s Why This Why Trailblazing Native American Politician Isn’t Accepting Her Colleague’s Apology“People should know how to conduct themselves. And if they don’t, then don’t run for office.”

Read more »

Opinion | Justice Thomas should recuse. Here’s why.If Justice Thomas doesn't recuse himself, the chief justice should nudge him to do so.

Opinion | Justice Thomas should recuse. Here’s why.If Justice Thomas doesn't recuse himself, the chief justice should nudge him to do so.

Read more »

The New York Stock Exchange Is Investigating Why Shopify’s Stock Freaked OutKen Griffin’s Citadel Securities is at the center of the probe into why the e-commerce company’s shares would jump about $100 in a minute.

The New York Stock Exchange Is Investigating Why Shopify’s Stock Freaked OutKen Griffin’s Citadel Securities is at the center of the probe into why the e-commerce company’s shares would jump about $100 in a minute.

Read more »

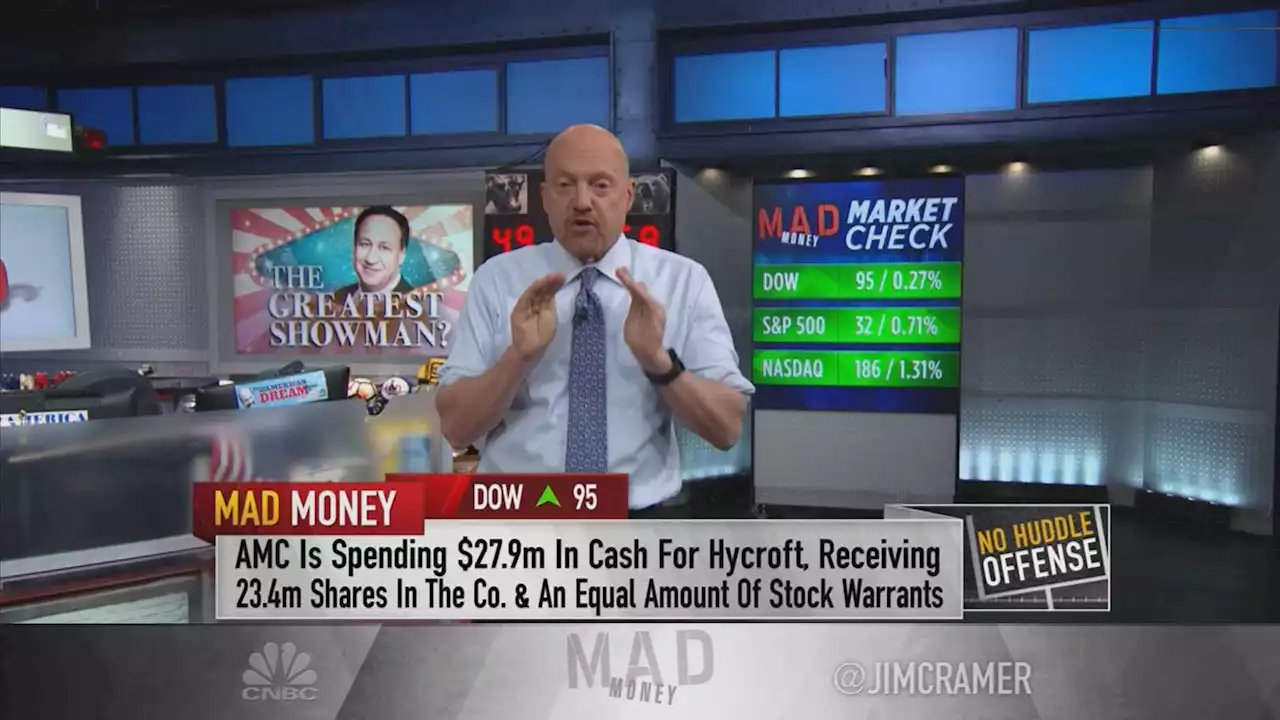

Jim Cramer explains why AMC stock skyrocketed on MondayCNBC's Jim Cramer discussed AMC's stock gains on Monday and the company's purchase of a gold mine in Monday's 'Mad Money.'

Jim Cramer explains why AMC stock skyrocketed on MondayCNBC's Jim Cramer discussed AMC's stock gains on Monday and the company's purchase of a gold mine in Monday's 'Mad Money.'

Read more »

Why stock-market investors aren't panicking over an inverted yield curveA closely watched measure of the Treasury yield curve briefly inverts, underlining recession worries. Here's what it means for the stock market.

Why stock-market investors aren't panicking over an inverted yield curveA closely watched measure of the Treasury yield curve briefly inverts, underlining recession worries. Here's what it means for the stock market.

Read more »