'Everything You Need to Know About DeFi, DAOs, and Investing in On-Chain Crypto Indexes' by indexcoop indexcoop indexcoopproducts

Yeah, it's good enough. All right. So Mike, so now you found, who did you find? Did you find Index Coop or Co-op, whatever we're calling it, and let us know what it is.

So I was getting exposure to many tokens by just buying one. I said, that is... I know that from traditional finance, that sounds great to me because all of this research is onerous. I mean, I'm sure at some of the crypto websites, there's some advertising, people talking about it, maybe on the back channels, but essentially this is an asset management firm that was created out of thin air, out of the traditional confines of BlackRock or JP Morgan or one of these type of places that creates their own funds.

So he launches the DAO, the Index Cooperative in October of 2020. We've gone from basically zero in AUM to half a billion roughly a year later. All right. So let's put a pin in the DAO for a sec, because I want to get into that and talk all about it. Sure. Okay. So Bank of America, Goldman Sachs, right? JP Morgan, these are intermediary institutions, financial institutions between borrowers and lenders, for example.

Again, borrowing and lending, trading, market making, asset management, insurance, but you don't have these large behemoths involved. And as a result, you can look to the code, it's 100% open sourced. That's right. There's a heavy dose of game theory and incentivization at every turn, right? So when a new product is launched or when a new pro...

They were rewarded just for using the project. And that kicked off what's known as DeFi Summer, just can bring explosion of different projects that came online and use those incentives to drive the growth of the network. Like, wait, what did I just dive into? Because the functions that it's replacing are really investment banking functions like lending and staking and trading and tokens and all of this sort of stuff that there is very little real world application today.

You can then borrow a stable coin and use that to make another purchase and you kind of take a step back and going, okay, I'm staking my tokens to borrow tokens, to buy tokens, to lever tokens, right? I got tokens from the Ethereum Name Service, ENS, and it was new to me. My friend, Justin Paterno told me six months ago buy Michaelbatnick.e. This will be your domain.

And instead of this fakakta idea that the power users would pay Twitter, what if Twitter pays their power users via tokens? What if, to Ben's point, if you make a really bad dad joke, you get docked. So [inaudible 00:13:09] acquisition costs, which is like the biggest missing piece, this like flips it on its head? Totally. Totally. My entrance into the DeFi world was, okay, I'm starting to understand that this could be huge.

I don't want to do it myself. And he said, oh, you can invest in an index and he pointed me to Index Coop and said, go there's this DeFi Pulse Index, go buy the index, he said. And so this again, September of 2020 is when this came up and there are a series of rules that this goes through. And so once a month, they will run their entire universe of DeFi protocols through those rules and see how many projects pass.

Like one rule is that it needs to have been out in the market for at least 180 days. One of the reasons, one of the main reasons that we do that is because we want to see that the project, the token, et cetera, are all working as hoped and that there aren't exploits or hacks or anything like that. Well, you can buy it on-chain, meaning you need to have an Ethereum wallet. How does that happen? And it's funny because I actually walked Leigh Drogen exactly through all of this stuff.

And that's where you can purchase one of these products, right? Let me tell you... And it can be done anywhere in the world. ... that's not how I did it. Here's how I did it. You buy the Ethereum, you hit transfer, you get a destination, you copy and paste your code. And then 30 seconds later, you've got Ethereum on your MetaMask wallet.

So where is this? Where are these tokens being held? In finance speak, who's the custodian here? In the metaverse, moron. You were the custodian. And our main job is to engage with the mainstream and try to make it more accessible for folks that are not going to do what Michael just laid out, right? You can hold it at the custodian. So there's exchanges where you can actually trade. And then a custodian allows you to hold tokens with an extra layer of security.

Because the people who are there now are probably the huge crypto heads who have been in this stuff for a while and know what they're doing. Yeah. They're real business models. This is what's so exciting I think for folks from traditional finance looking at this, this is not just purely number go up and number also go down, right?

So on the size of the whole trade, right, 30 basis points fee, five of those 30 basis points goes to the project. And so as SushiSwap continues to grow and the volumes continue to increase, that's more and more cash flows that are going to the project. And if it's gotten to a scale where it's... I mean, right now, it's starting to get to a point where it's on Coinbase's radar, right? Like they're doing billions of dollars today.

It sounds like a joke. Right. Yeah. So, the governance token, this is interesting from the Index Cooperative aspect as well. So there actually is an index token here, right? So we're going to have a DeFi 2.0 product, which is effectively smaller cap projects that haven't taken off as much as the ones that are in DPI, really excited about that product by the way, but... By the way, sorry to cut you off.

That's how it gets passed. So these products, like who writes these proposals? Are there lawyers that work for the... Do you outsource some of these contracts? Are they contracts or is it literally like a 10 year old could read it and understand what goes on? Some people will love it. Some people will hate it. And in doing so, the product methodologist will get feedback. Then they'll come back with a form of a proposal and that'll go up for a vote.

So all of the products have what are called streaming fees. You could think of them like expense ratios. I'm just curious to who actually writes these proposals. Yeah. Most of them are I'm in favor or I'm against. I think we're moving to a place where there's going to be more than those two options, but we try to keep it pretty simple.

And then there's some folks who it's very part-time, they come in, maybe they work on a project. Maybe they translate one of our articles into another language, stuff like that. But that pretty much happens across all the various working groups on a monthly basis. And then people will receive automatically in their wallets, those governance tokens they earned in the prior month. Is this global?

I think one of the tricky things with the DAO is there is no CEO. And so things just happen in a more deliberate, slower pace than if someone was in charge and making a very decisive decision. So I went to TOKEN2049 in London. I was down at Bitcoin Miami and here in New York at Mainnet NYC, NFT.NYC, and so got to meet people who came in from all walks of the planet.

So there's nothing to... Like, even if they wanted to hack. So the way that I got hacked was very foolish. I gave away the keys to my house and the alarm password. They basically perform a function. They can do many different things. Okay. And they allow for decentralized finance. That's why decentralized finance is on Ethereum and you don't really hear that. It's not on Bitcoin, right?

What does the contract look like? For example, Mike, could you see a smart contract and be like, oh, I know what that means, or is it like code? Oh, it's code. Yeah. I mean, I think that's fair. There are security based channels set up across a lot of the big protocols. So when that hack that I mentioned happened, everyone, the community at large, not just a given project, but all the projects are learning from each other and enhancing the code all the time.

So right now you've got the Defi Pulse Index, which we've spoken about. There's a Metaverse Index, there's a Data Economy Index. Aside from the indexes, which I'm sure you'll make more of, are there other projects that you're looking into or are you laser focused on this segment of the ecosystem? That's where our leverage products get in. And that is a theme, I think we're going to be building, not just more leverage products, but also other types of other tokens that will abstract away processes that are painful and annoying for the end user, right?

So being able to buy one token, but then getting exposure to eight to 10 different stablecoin strategies, where in DeFi the yield, because there's no intermediary is much more attractive than when you can get in traditional finance. Does that concern you at all or not really? I mean, I think everyone in the space is looking for more clarity. So it'll probably be a good thing, perhaps not in the short term, because we need to react to it.

Yes. I mean, it would be harder to do because you're not dealing with a single management team orchestrating that. So you'd have to buy up on decentralized exchange [crosstalk 00:38:19]. Wait, what do your parents say? Like Mike, what do you do? What do you tell them? Oh my God. When you go to a bar, how do you explain this to people? My dad just shakes his head.

Ireland Latest News, Ireland Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

MultiVersus Roster, Gameplay, and Release Info: Everything You Need to Know | HackerNoonNo, this isn't a fever dream. Shaggy and Batman are really teaming up to fight together. That's how wacky the MultiVersus roster is, and we can't wait for more.

MultiVersus Roster, Gameplay, and Release Info: Everything You Need to Know | HackerNoonNo, this isn't a fever dream. Shaggy and Batman are really teaming up to fight together. That's how wacky the MultiVersus roster is, and we can't wait for more.

Read more »

Feral hogs and their meat: This is what you need to know about chomping down on these Texas swineFeral hogs and their meat: This is what you need to know about chomping down on these Texas swine KPRC2

Feral hogs and their meat: This is what you need to know about chomping down on these Texas swineFeral hogs and their meat: This is what you need to know about chomping down on these Texas swine KPRC2

Read more »

So, How Does Monkeypox Typically Spread?Everything you need to know about how people contract the virus.

So, How Does Monkeypox Typically Spread?Everything you need to know about how people contract the virus.

Read more »

Staking and Savings on Crypto.com - Everything You Need to Know | CoinMarketCap.cryptocom offers numerous products and services that allow you to earn passive income 💪 Today, CMCAlexandria will deep dive into staking and savings options offered by the exchange.

Staking and Savings on Crypto.com - Everything You Need to Know | CoinMarketCap.cryptocom offers numerous products and services that allow you to earn passive income 💪 Today, CMCAlexandria will deep dive into staking and savings options offered by the exchange.

Read more »

The Future of Finance Writing Contest by Bricktrade x HackerNoon | HackerNoon'The Future of Finance Writing Contest by Bricktrade x HackerNoon' by hackernoon futureoffinance brick_trade

The Future of Finance Writing Contest by Bricktrade x HackerNoon | HackerNoon'The Future of Finance Writing Contest by Bricktrade x HackerNoon' by hackernoon futureoffinance brick_trade

Read more »

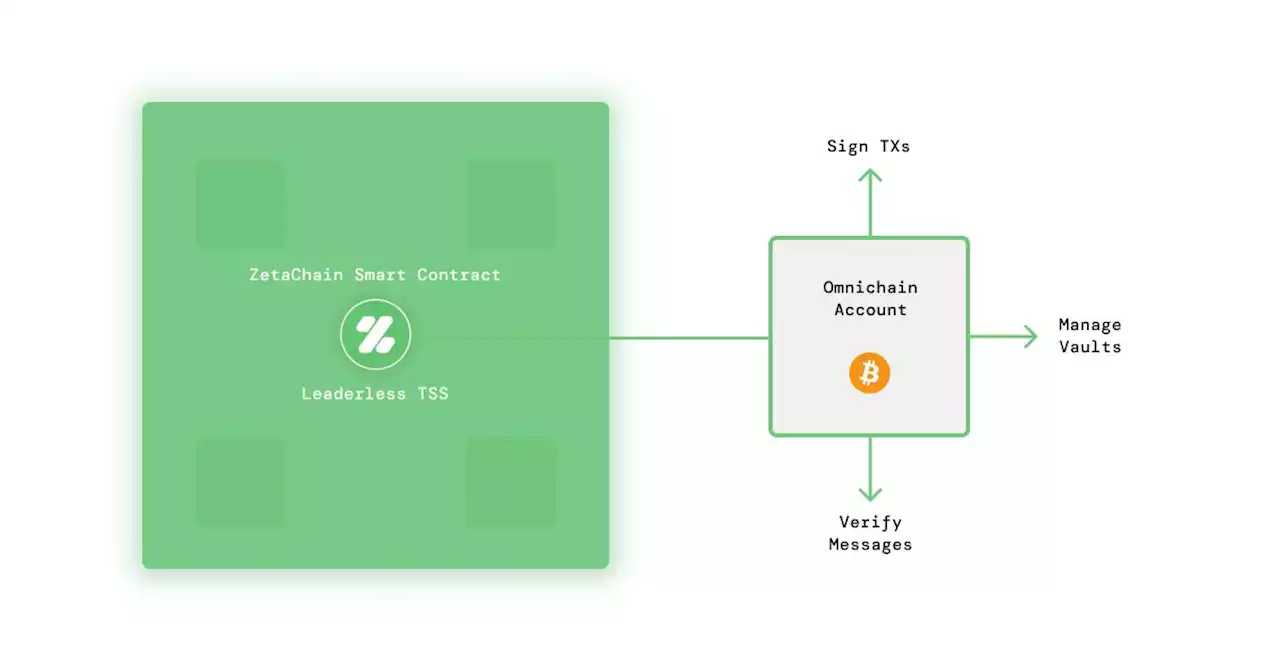

Introducing Omnichain Accounts | HackerNoonLearn how a new crypto primitive gives smart contract capabilities to legacy chains like Bitcoin and what this means for the crypto ecosystem.

Introducing Omnichain Accounts | HackerNoonLearn how a new crypto primitive gives smart contract capabilities to legacy chains like Bitcoin and what this means for the crypto ecosystem.

Read more »