💷 Exactly how much you have to save 💷 How to pay as little tax as possible when you take your money out 💷 And why our state pension is among the lowest in Europe How to avoid going broke in retirement, by former pensions minister stevewebb1 ⤵️

Steve Webb may be the person to thank for having a pension, as, during his time in charge of retirement savings for the country, he rolled out auto-enrolment. This is where an employer has to open a pensionWebb was the pensions minister from 2010 to 2015 and is now a partner with pensions consultants LCP.

Or, you can get 25 per cent tax-free every time you take money out and then pay tax on the other 75 per cent. You might do that because you’re going to keep it invested to grow your fund. So basically: do you take all the tax-free cash at the start, or do you take tax-free cash on every little chunk?

You have to see the system as a whole, and it is designed on the assumption that you have a state pension and a workplace one. In terms of how much we receive in state pension versus other countries, it’s very low – one of the lowest relative to wages in Europe. There are over seven million people building up defined benefit pensions – mainly public sector workers. Very few people in the private sector are getting a new one. The important thing to know with these pensions is that they are really valuable. If you’re a teacher or a nurse, and your union keeps telling you how badly you are being treated, you may have this perception that it’s hardly worth it. But what people don’t see is the money their employers are putting in.

With an annuity you don’t need to worry how long you live, or how the money is invested. And for most of us – Warren Buffet excepted – looking after our investments in old age is a hassle. But if you’re the type of person lying awake at night sweating about the stock market and what’s happening to your pot of money and all that kind of thing, it’s probably best to recognise that you will want lower risk. You will get lower return, but more security.

Ireland Latest News, Ireland Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Exactly How Coperni Plotted A Canine Follow-Up To Bella’s Spray-On DressSébastien Meyer and Arnaud Vaillant had a “pack” of robot dogs join models on the runway at their autumn/winter 2023 show in Paris.

Exactly How Coperni Plotted A Canine Follow-Up To Bella’s Spray-On DressSébastien Meyer and Arnaud Vaillant had a “pack” of robot dogs join models on the runway at their autumn/winter 2023 show in Paris.

Read more »

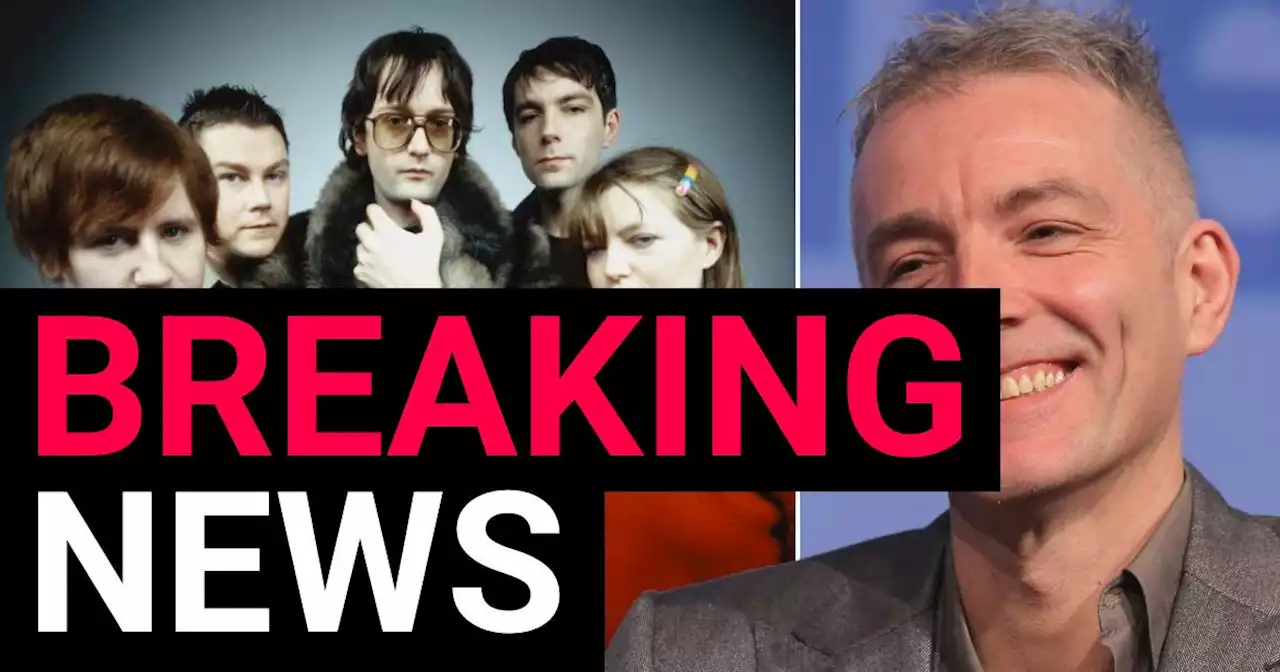

Pulp bass player Steve Mackey dies aged 56BREAKING: Pulp bass player Steve Mackey has died aged 56.

Pulp bass player Steve Mackey dies aged 56BREAKING: Pulp bass player Steve Mackey has died aged 56.

Read more »

Pulp bassist Steve Mackey dead as band pays tribute to ‘beloved friend’PULP Bassist Steve Mackey has died aged 56 with his fellow bandmates paying tribute to their “beloved friend”. They shared the heartbreaking news on social media today. In a Twitter pos…

Pulp bassist Steve Mackey dead as band pays tribute to ‘beloved friend’PULP Bassist Steve Mackey has died aged 56 with his fellow bandmates paying tribute to their “beloved friend”. They shared the heartbreaking news on social media today. In a Twitter pos…

Read more »

Pulp's Steve Mackey dead aged 56 as wife posts heartbreaking tributeSteve's wife Katie Grand, confirmed the sad news in a social media post as she posted a black and white photo of him smiling.

Pulp's Steve Mackey dead aged 56 as wife posts heartbreaking tributeSteve's wife Katie Grand, confirmed the sad news in a social media post as she posted a black and white photo of him smiling.

Read more »

Pulp bassist Steve Mackey dies aged 56The musician, who had been in hospital for the past three months, died on Thursday morning.

Pulp bassist Steve Mackey dies aged 56The musician, who had been in hospital for the past three months, died on Thursday morning.

Read more »