A new auto-enrolment pension scheme, named My Future Fund, will come into effect in Ireland at the end of September 2025. This scheme aims to bridge the income gap experienced by many retirees and ensure a more secure financial future.

Last year, the Government announced that the new auto-enrolment pension scheme will come into effect at the end of September 2025, benefiting around 800,000 workers in the State. The current state pension is €277.30 per week, or just over €14,400 per year. Both Fianna Fáil and Fine Gael have pledged to raise this to €350 per week over the lifetime of the next Dáil. While many workers also have a private pension, around 1 in 3 people have no additional pension coverage.

Read more: Social welfare Ireland: End date for Fuel Allowance payments confirmed after new rules for 2025 Read more: Social welfare Ireland: Increase €244 payment by over 50% by meeting one condition As the average salary is over €40,000, many people therefore experience a reduction in their weekly income of more than 50% when they retire. Auto-enrolment, named My Future Fund, will bridge this gap, automatically enrolling those aged between 23 and 65 who earn over €20,000 per year and are not already part of a pension plan. Under the new scheme beginning in September this year, for every €3 taken from your paycheck, a total of €7 will be invested in your pension. This is because your employer must match your contribution of €3 with €3 of their own, and the State will contribute a further €1 for every €3 personally contributed. Employee contributions will initially start at 1.5% of gross pay, eventually scaling to 6% of gross pay after 10 years. This will mean that a worker on the national average wage contributing consistently for 40 years could build up a savings pot of nearly €750,000 over the course of their working life. Qualified Financial Advisor James Dorrian of the National Pension Helpline explained how this will affect employees with different salaries. “For a worker earning €20,000 per annum, they will contribute 1.5% of their salary per year for the first three years, which must be matched by their employer,” he said. “This works out at €300 per year – or €600 in total. The government then pays an additional 0.5% (€100).” 'From year 4 to 6 of the scheme, the contribution rate rises to 3% for the employee, which works out at €1,400 after employer and State payments. 'In years 7 to 9, the employee earning €20,000 (and their employer) will pay 4.5% (€900) and the government will contribute 1.5% (€300).' 'Finally, after year 10, the employee contribution rate rises to 6% (€1,200), matched by their employer, and the government pays 2% or €400.' While those earning less than €20,000 per year will not be auto-enrolled, they can choose to opt-in to the scheme provided they are not already part of another scheme. People can also opt-out of the scheme after a mandatory participation period of 6 months, but they will be automatically re-enrolled after 2 years. Mr Dorrian explained that an employee earning €40,000 per year, which is around the average yearly income, will pay €600 for the first three years, rising to €1,200 after 3 years and €1,800 from year 7. “They will then contribute €2,400 from year 10, and these contributions must also be matched by their employer,” he said. “The government will pay 200 for the first three years, rising to 800 per year after year 10. This means that the employee earning €40,000 per year will be contributing €2,400 after year 10, while €5,600 will be added to their pension account.” “While auto-enrolment technically represents better value for lower earners, this advantage diminishes when you consider that employee contributions via auto-enrolment are initially limited to 1.5% of gross pay.” “On the other hand, with a private retirement savings account, or PRSA, employees can contribute anywhere between 15% and 40% of their salary, depending on their age.” “While auto-enrolment solves the problem of having a private pension – it doesn’t solve the problem of having enough of a private pension.

PENSION IRELAND AUTO-ENROLMENT FINANCE RETIREMENT

Ireland Latest News, Ireland Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Awareness of Ireland's Automatic Enrolment Pension Scheme GrowsA new study reveals increasing awareness of Ireland's upcoming automatic enrolment pension scheme, with 28% of workers now familiar with the initiative. The scheme, set to launch in late 2025, will see workers automatically enrolled in a retirement savings plan unless they opt out.

Awareness of Ireland's Automatic Enrolment Pension Scheme GrowsA new study reveals increasing awareness of Ireland's upcoming automatic enrolment pension scheme, with 28% of workers now familiar with the initiative. The scheme, set to launch in late 2025, will see workers automatically enrolled in a retirement savings plan unless they opt out.

Read more »

Only 28% Aware of Upcoming Pension Auto-Enrolment SchemeA new pension scheme, with automatic enrolment, is set to begin in 9 months but only 28% of those who will be enrolled are aware of it, according to the Central Statistics Office (CSO). The scheme will see employers, employees, and the state each contribute to a pension pot.

Only 28% Aware of Upcoming Pension Auto-Enrolment SchemeA new pension scheme, with automatic enrolment, is set to begin in 9 months but only 28% of those who will be enrolled are aware of it, according to the Central Statistics Office (CSO). The scheme will see employers, employees, and the state each contribute to a pension pot.

Read more »

Jordie Barrett: ‘I came to Leinster to grow my game’New arrival from New Zealand says ‘family affinity to Ireland’ helped convince him to join province

Jordie Barrett: ‘I came to Leinster to grow my game’New arrival from New Zealand says ‘family affinity to Ireland’ helped convince him to join province

Read more »

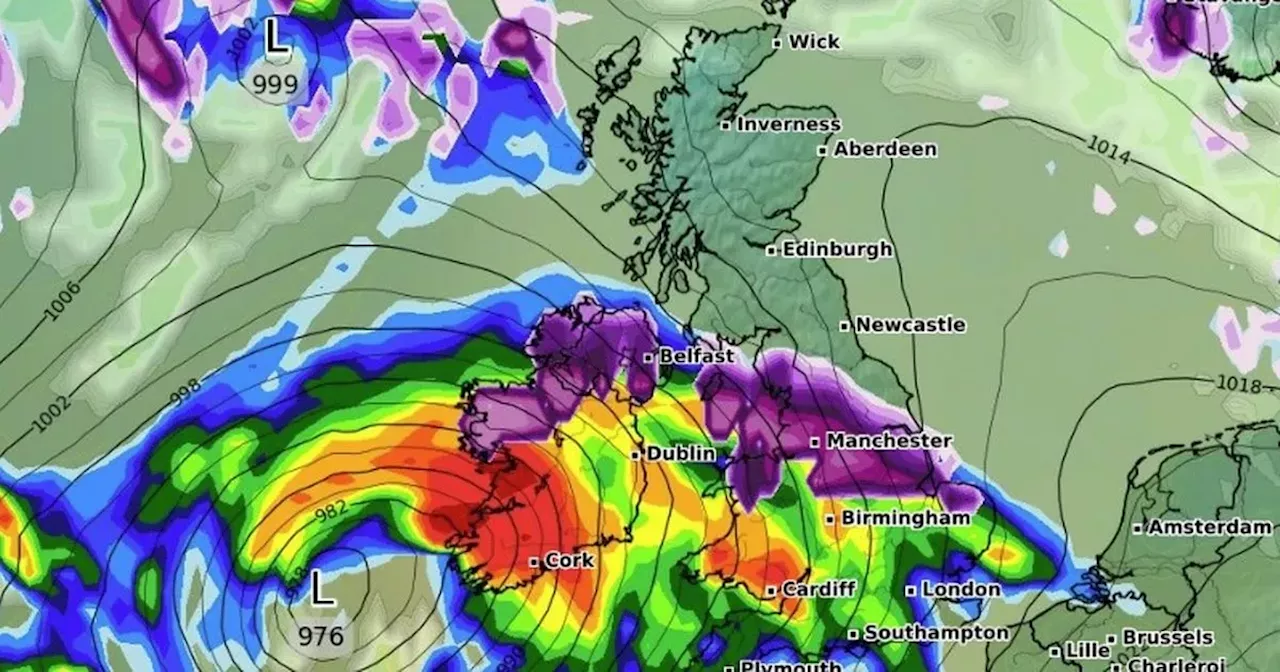

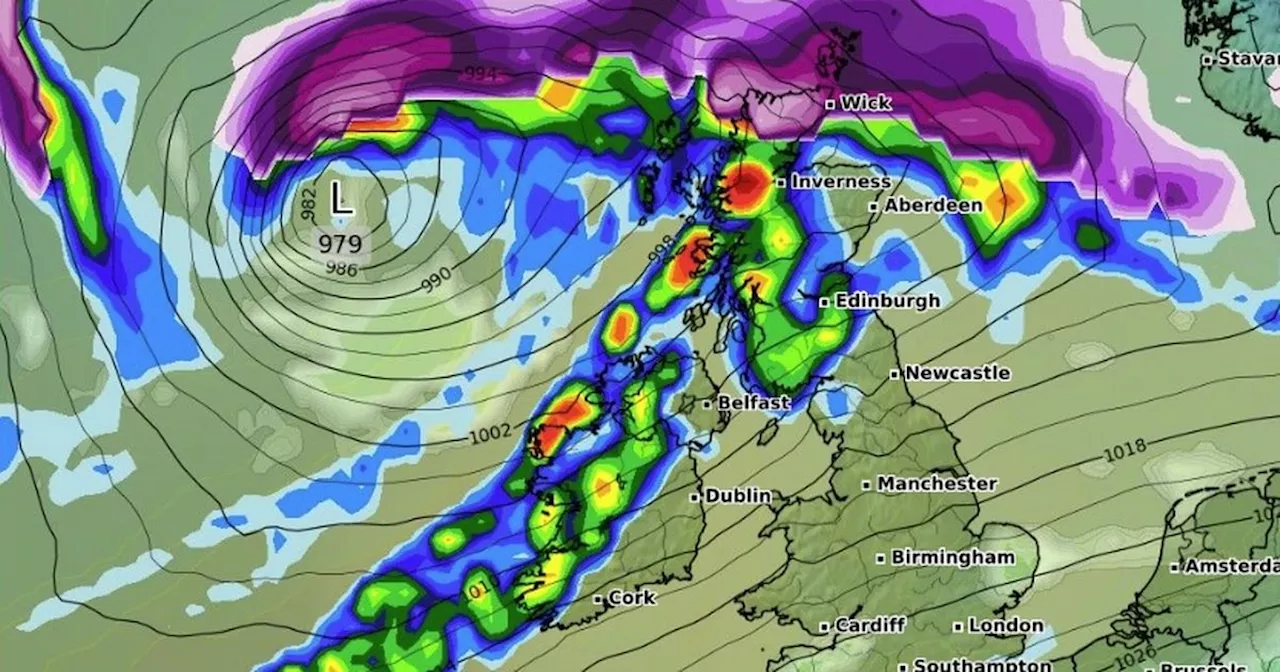

Heavy Snowfall Potential for Ireland on New Year's Eve and New Year's DayNew weather charts predict heavy snowfall across parts of Ireland, particularly in the west, on New Year's Eve and New Year's Day. While long-range forecasts are uncertain, meteorologists suggest a possibility of colder conditions and unsettled weather in the coming days.

Heavy Snowfall Potential for Ireland on New Year's Eve and New Year's DayNew weather charts predict heavy snowfall across parts of Ireland, particularly in the west, on New Year's Eve and New Year's Day. While long-range forecasts are uncertain, meteorologists suggest a possibility of colder conditions and unsettled weather in the coming days.

Read more »

Heavy Snowfall Predicted for Ireland on New Year's Eve and New Year's DayNew weather charts suggest heavy snowfall across parts of Ireland, particularly in the west, for New Year's Eve and New Year's Day. While long-range forecasts are uncertain, meteorologists indicate a trend towards cooler weather and possible snow events in early January.

Heavy Snowfall Predicted for Ireland on New Year's Eve and New Year's DayNew weather charts suggest heavy snowfall across parts of Ireland, particularly in the west, for New Year's Eve and New Year's Day. While long-range forecasts are uncertain, meteorologists indicate a trend towards cooler weather and possible snow events in early January.

Read more »

Ireland Braces for 'Significant and Impactful' Weather on New Year's Eve and into New YearMet Eireann has issued warnings of potentially heavy rain, strong winds, and even sleet and snow for the coming days as Ireland rings in the New Year. The national forecaster predicts a series of low pressure systems will bring widespread unsettled weather, starting on December 31st with heavy rain and strong winds in the northwest. Another, more significant, low pressure system is expected on Wednesday, bringing very strong and blustery winds and heavy rain to all areas. The forecaster warns of potential river level increases and surface water flooding.

Ireland Braces for 'Significant and Impactful' Weather on New Year's Eve and into New YearMet Eireann has issued warnings of potentially heavy rain, strong winds, and even sleet and snow for the coming days as Ireland rings in the New Year. The national forecaster predicts a series of low pressure systems will bring widespread unsettled weather, starting on December 31st with heavy rain and strong winds in the northwest. Another, more significant, low pressure system is expected on Wednesday, bringing very strong and blustery winds and heavy rain to all areas. The forecaster warns of potential river level increases and surface water flooding.

Read more »